- Founded: 2014

- Headquarters: Seychelles

- Min deposit: 100 USD

- Max Leverage: 1 : 1000

In the diverse and competitive world of online trading, choosing the right broker can make a significant difference in a trader’s journey. Tickmill, established in 2014, has quickly risen to prominence with a strong focus on providing a tailored trading experience to both novice and experienced traders in the MENA region. This comprehensive review evaluates Tickmill’s offerings, assessing everything from platform usability to customer support, regulatory status, and trading conditions.

Company Overview

Tickmill is an international Forex and derivatives broker specializing in commodities, stock indices, bonds, and currencies. Headquartered in London, Tickmill maintains a robust presence in the MENA region, ensuring compliance with local regulations and a deep understanding of the local market nuances.

Trading Platforms

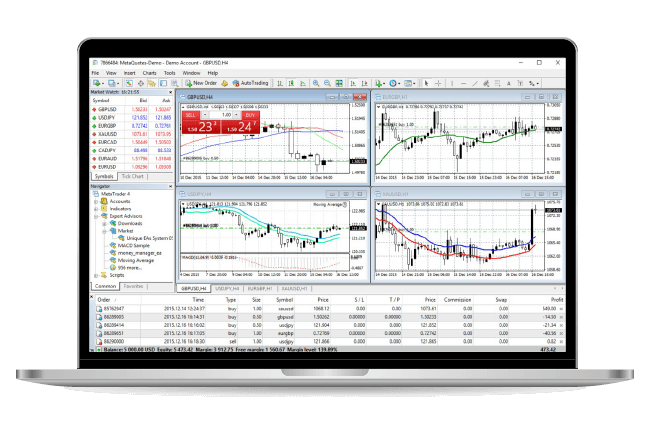

Tickmill understands the importance of a reliable and intuitive trading platform, which is why it offers its clients access to MetaTrader 4 (MT4), one of the most popular platforms in the trading community worldwide. MT4 is renowned for its user-friendly interface, robust functionality, and flexibility, making it an excellent choice for traders of all skill levels.

Features of MetaTrader 4:

- Advanced Charting Tools: MT4 provides a comprehensive set of charting tools that allow traders to analyze price movements with precision. Users can access over 30 built-in indicators and more than 2,000 free custom indicators, as well as 700 paid ones.

- Expert Advisors (EAs): Tickmill’s MT4 platform supports automated trading through Expert Advisors. Traders can program their own EAs or download existing ones to automate their trading strategies.

- Multi-Device Compatibility: Tickmill’s MT4 platform can be accessed on desktop (Windows and Mac), web, and mobile (iOS and Android), ensuring traders can monitor the markets and execute trades from anywhere at any time.

In addition to MT4, Tickmill provides access to MetaTrader 5 (MT5), which offers all the features of MT4 along with additional capabilities such as more timeframes, more technical indicators, and an integrated economic calendar. The inclusion of MT5 caters to traders looking for more advanced trading tools and functionalities.

Tradable Assets

Tickmill provides a diverse range of tradable assets that meet the needs of various trading strategies, risk appetites, and interests:

Forex: Traders have access to over 60 currency pairs, including major, minor, and exotic pairs, allowing for a wide range of forex trading strategies.

Indices: Tickmill offers trading on a variety of global indices, which is ideal for those interested in speculating on the world’s major economic markets.

Commodities: The broker provides the ability to trade various commodities, including precious metals like gold and silver, and energy commodities such as Brent and Crude Oil.

Bonds: For those looking for a more stable investment, Tickmill offers trading on German government bonds, which are considered low-risk financial instruments.

This wide selection ensures that traders can diversify their portfolios within the same platform, reducing the need to operate multiple accounts with different brokers.

Account Types

Tickmill caters to a wide range of traders by offering various account types, each designed to meet different trading needs and experiences:

- Classic Account: Ideal for novice traders, the Classic account offers no commissions, competitive spreads, and a minimum deposit requirement of just $100. This account type allows traders to experience Tickmill’s trading environment with lower risk.

- Pro Account: Targeted towards more experienced traders, the Pro account features ultra-low spreads starting from 0 pips and a low commission of $2 per side per $100,000 traded. This account is suitable for high-volume traders looking for tight spreads.

- VIP Account: For elite traders able to maintain a balance of $50,000 or more, the VIP account offers even lower commission rates and personalized customer service from Tickmill.

- Islamic Account: Catering to the MENA region’s substantial Muslim population, Tickmill offers an Islamic account that complies with Sharia law. This account excludes swap fees and commissions, providing a halal trading option for observant Muslims.

Each account type provides access to all trading platforms and instruments, with the flexibility to upgrade as the trader’s needs evolve.

Deposits and Withdrawals

Tickmill simplifies the funding and withdrawal process, making it accessible and efficient for traders. Clients can fund their accounts using various methods, including major credit cards, bank wire transfers, and e-wallets such as Skrill, Neteller, and FasaPay. Importantly, Tickmill does not charge any fees for deposits or withdrawals, which is a significant advantage for traders looking to maximize their trading potential.

The processing times for deposits are exceptionally fast. Credit card and e-wallet transactions are processed almost instantaneously, while bank wires may take between 1 to 3 business days, depending on the bank’s policies and procedures. Withdrawals are equally efficient, with most requests processed within one business day, although the arrival times may vary depending on the withdrawal method used.

Tickmill has a minimum deposit requirement of $100, which is relatively low and appealing to new traders who may not wish to commit a large amount of capital initially. The broker also supports multiple currencies for account funding, which reduces the need for currency conversion and associated costs for traders in the MENA region.

Fees and Costs

Tickmill is known for its competitive pricing structure, which is designed to accommodate all types of traders. The broker offers several account types, including the Classic Account, the Pro Account, and the VIP Account, each tailored to different trading styles and volumes.

The Classic Account does not involve any commissions, and traders can benefit from spreads starting from 1.6 pips. This account is suitable for novice traders who prefer a simple cost structure. On the other hand, the Pro and VIP accounts offer spreads from as low as 0 pips and charge a commission of $2 per side for each lot traded. These accounts are ideal for high-volume traders who can benefit from lower spreads and a commission-based cost structure.

Moreover, Tickmill does not charge inactivity fees, which is a noteworthy feature for traders who may not be consistently active. However, overnight fees, or swaps, are charged on positions that are held open overnight, which is standard practice in the industry.

Education and Resources

Tickmill excels in providing educational resources and trading tools that enhance the trading experience and improve the skills of its clients. The broker’s commitment to education is evident through its extensive range of materials, which include webinars, seminars, eBooks, infographics, and articles on various trading topics.

The webinars and seminars are particularly beneficial, covering a wide range of topics from introductory concepts to advanced trading strategies. These sessions are conducted by experienced market analysts and provide valuable insights into market dynamics and trading techniques.

In addition to educational content, Tickmill offers several practical trading tools. The economic calendar is a useful feature for all traders to keep track of important financial events that could impact the markets. Moreover, Tickmill provides an advanced research portal that includes market insights and trading ideas available to clients.

The broker’s website also features a ‘Trader’s Blog’ where traders can read about market analysis, trading strategies, and other relevant topics. This blog is regularly updated and serves as an excellent resource for staying informed about the latest market trends.

Customer Support

Tickmill understands that reliable customer support is crucial, particularly in the fast-paced trading environment. They offer support through multiple channels including live chat, email, and phone, ensuring that traders can reach out in whatever way they find most convenient. The response times are impressive, with live chat and phone inquiries typically being addressed within a few minutes.

Additionally, Tickmill provides support in several languages, which is a significant advantage for traders in the linguistically diverse MENA region. Their customer service representatives are knowledgeable and well-trained, capable of handling a range of issues from account queries to technical support.

Security

Security is a paramount concern for all traders, and Tickmill takes this aspect seriously. They are regulated by several reputable bodies, including the UK’s Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), which ensures they adhere to strict financial standards and offer high levels of client protection.

Tickmill uses advanced encryption technologies to secure user data and financial transactions. They also maintain segregated accounts for client funds, ensuring that these are kept separate from the company’s own funds, offering an additional layer of security against any financial mismanagement.

User Reviews and Community

Tickmill boasts a robust online presence with a thriving community of traders. User reviews across various forums and review sites generally paint a positive picture, with many traders praising the platform for its user-friendly interface and excellent trading conditions.

The community aspect is further enhanced by regular webinars, workshops, and trading contests that Tickmill hosts, fostering a sense of community and providing educational opportunities for traders at all levels. These initiatives not only help traders learn and develop their skills but also encourage engagement within the Tickmill community.

Trust

The trust factor is critical in the brokerage world, and Tickmill scores highly on this front. Having been in operation since 2015, Tickmill has established itself as a trustworthy broker in the MENA region and beyond. Their commitment to transparency is evident through clear and detailed information on their website about their trading conditions, fees, and regulatory status.

Moreover, Tickmill’s record of compliance with various regulatory bodies and their proactive approach to client security and protection contribute significantly to their trustworthy reputation.

Pros and Cons

- Regulated by FCA and CySEC: Ensures high standards of safety and financial integrity.

- Competitive spreads and low trading costs: Ideal for all types of traders.

- Excellent educational resources: Supports trader development with comprehensive educational tools.

- Strong technological infrastructure: Offers a stable and reliable trading platform.

- Limited product portfolio: Primarily offers forex and CFDs, which might be restrictive for traders interested in a wider range of investment options.

- No 24/7 customer support: While support is efficient, it is not available round-the-clock.

- Restricted leverage for retail clients in certain regions: Due to regulatory limits, leverage is capped, which might affect trading strategies of certain traders.

Conclusion

Tickmill’s commitment to providing a secure, reliable, and user-friendly trading environment makes it a compelling choice for traders in the MENA region. With its robust regulatory status, competitive cost structure, and comprehensive educational resources, Tickmill caters to both new and experienced traders looking for an edge in forex and derivatives trading.

In the fast-evolving world of online trading, having a broker like Tickmill, which combines technological efficiency with a deep understanding of trader needs and market dynamics, can significantly contribute to a trader’s success in the global markets.

FAQ

Tickmill offers several account types to cater to different trader needs, including the Classic Account, Pro Account, and VIP Account. Each account type has unique features and benefits, such as varying spreads and commission structures. Tickmill also provides a demo account for those looking to practice trading without financial risk.

Yes, Tickmill is a highly regulated broker. It is regulated by some of the world’s leading authorities including the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). This regulation helps ensure that Tickmill adheres to strict financial standards and offers a high level of client protection.

Tickmill primarily offers the MetaTrader 4 (MT4) platform, widely recognized for its user-friendly interface and robust features, including advanced charting tools, automated trading capabilities, and comprehensive market analysis options. MT4 is available for desktop, web, and mobile applications, ensuring traders can access the markets at any time from anywhere.

Tickmill takes the security of client funds seriously. The broker employs several security measures including using segregated accounts to keep clients’ funds separate from the company’s funds. Additionally, Tickmill uses advanced encryption technologies to safeguard data and financial transactions.

Yes, Tickmill allows trading in a variety of cryptocurrencies through CFDs (Contracts for Difference), giving traders the opportunity to speculate on the price movements of cryptocurrencies without the need to own the actual digital currencies.

Tickmill offers multiple methods for depositing and withdrawing funds, including bank wire transfers, credit/debit cards, and e-wallets such as Skrill, Neteller, and WebMoney. Tickmill prides itself on quick processing times, though the time it takes can vary depending on the method used.

Tickmill is known for its low trading costs. There are no fees for deposits or withdrawals. However, trading fees vary depending on the account type. The Pro and VIP accounts feature lower spreads but include a commission per trade, whereas the Classic account has no commission but higher spreads.