- Founded: 1996

- Headquarters: Canada

- Min deposit: 1 GBP

- Max Leverage: 1 : 200

OANDA is a well-established name in the forex and CFD trading industry, known for its robust trading platform, competitive pricing, and extensive range of financial instruments. With over two decades of experience, OANDA has carved a niche for itself by providing a seamless trading experience to both novice and professional traders. This review will delve into the various aspects of OANDA, evaluating its strengths and areas for improvement, particularly for traders in the MENA region.

About

Founded in 1996, OANDA has grown to become one of the most trusted brokers in the industry. It is regulated by several top-tier financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Commodity Futures Trading Commission (CFTC) in the US. OANDA’s global presence is complemented by its commitment to transparency, reliability, and superior customer service.

Trading Platforms

OANDA offers a range of trading platforms to cater to different types of traders, from beginners to seasoned professionals. The main platforms provided by OANDA include:

OANDA WebTrader:

User-Friendly Interface: OANDA WebTrader is known for its intuitive and easy-to-navigate interface, making it ideal for both new and experienced traders.

Advanced Charting Tools: The platform includes advanced charting tools with a variety of technical indicators to help traders make informed decisions.

Real-Time Data: Real-time market data ensures that traders are always up-to-date with the latest market movements.

MetaTrader 4 (MT4):

Industry Standard: MT4 is one of the most popular trading platforms globally, known for its robust features and reliability.

Customizable: Traders can customize their trading environment with a range of plugins and expert advisors (EAs).

Automated Trading: The platform supports automated trading through EAs, allowing for algorithmic trading strategies.

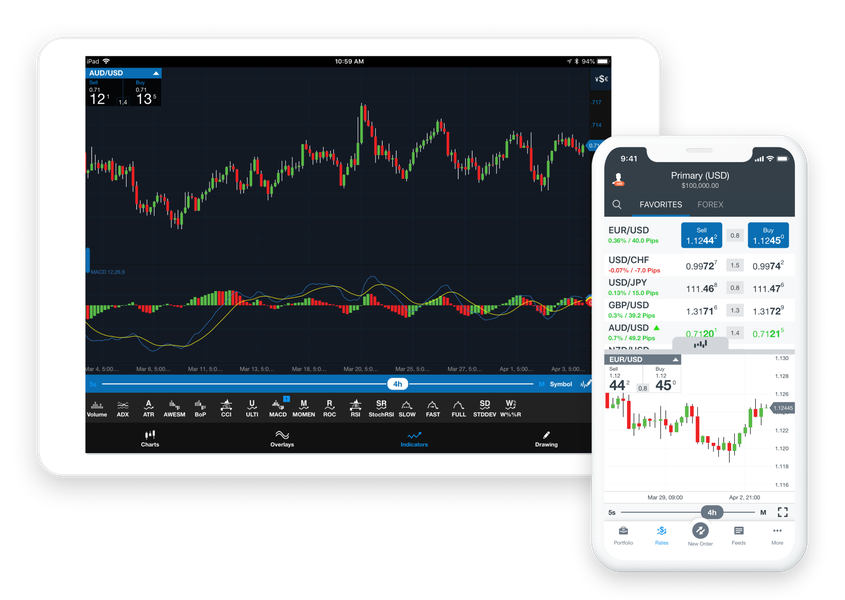

Mobile Trading:

On-the-Go Access: OANDA’s mobile trading app provides traders with the flexibility to manage their accounts and trade from anywhere.

Sync with WebTrader: The mobile app syncs seamlessly with the WebTrader platform, ensuring a consistent trading experience across devices.

Tradable Assets

OANDA offers a diverse range of tradable assets, ensuring that traders have ample opportunities to diversify their portfolios. The key asset classes available include:

Forex:

Major Pairs: Trade major currency pairs like EUR/USD, GBP/USD, and USD/JPY.

Minor and Exotic Pairs: OANDA also offers a variety of minor and exotic currency pairs for traders looking to explore different markets.

Commodities:

Precious Metals: Trade popular precious metals like gold and silver.

Energy Products: Access to energy commodities such as crude oil and natural gas.

Indices:

Global Indices: Trade major global indices including the S&P 500, NASDAQ, FTSE 100, and more.

Regional Indices: OANDA also provides access to regional indices, catering to the specific interests of traders in the MENA region.

Bonds:

Government Bonds: Trade government bonds from various countries, offering a secure investment option.

Cryptocurrencies:

Popular Digital Assets: OANDA has recently expanded its offerings to include popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

Account Types

OANDA provides a variety of account types to meet the diverse needs of its clients. These include:

Standard Account:

Low Minimum Deposit: The standard account requires a low minimum deposit, making it accessible to new traders.

Competitive Spreads: Enjoy competitive spreads across various asset classes.

No Commission: Trade without paying commissions, as costs are built into the spreads.

Premium Account:

Higher Minimum Deposit: This account type requires a higher minimum deposit, targeting more experienced traders.

Lower Spreads: Benefit from lower spreads compared to the standard account.

Dedicated Account Manager: Premium account holders receive personalized support from a dedicated account manager.

Professional Account:

Eligibility Criteria: Available to traders who meet specific eligibility criteria, such as trading volume and experience.

Enhanced Features: Enjoy enhanced trading features, including higher leverage and lower costs.

Regulatory Protections: Professional accounts may have different regulatory protections compared to retail accounts.

Islamic Account:

Sharia-Compliant: OANDA offers Islamic accounts that comply with Sharia law, ensuring no interest is charged or earned.

Same Trading Conditions: Islamic account holders enjoy the same trading conditions as other account types.

Deposits and Withdrawals

- Local and International Transfers: Supports both local and international bank transfers, making it easy for traders in the MENA region to fund their accounts.

- Processing Time: Bank transfers typically take 1-3 business days to process.

- Instant Deposits: Deposits via credit or debit card are usually processed instantly, allowing for quick access to trading funds.

- Security: OANDA employs advanced security measures to protect card transactions.

- Popular E-Wallets: Supports popular e-wallets like PayPal, Skrill, and Neteller.

- Fast Transactions: E-wallet transactions are typically processed within a few hours.

- Crypto Deposits: OANDA has recently started accepting cryptocurrency deposits, providing an additional funding option for clients.

Fees and Costs

Education and Resources

Customer Support

Security

User Reviews and Community Trust

Pros and Cons

Regulated and Secure: OANDA’s regulation by top-tier authorities and its robust security measures ensure a safe trading environment.

User-Friendly Platforms: The availability of MT4 and OANDA Trade platforms caters to traders of all experience levels, providing powerful tools and features.

Competitive Pricing: OANDA offers tight spreads and transparent pricing, making it a cost-effective choice for traders.

Educational Resources: OANDA provides a wealth of educational materials, including webinars, tutorials, and market analysis, helping traders improve their skills and knowledge.

Flexible Account Options: OANDA offers various account types, including standard and premium accounts, allowing traders to choose one that suits their needs.

Comprehensive Customer Support: The 24/5 customer support ensures that assistance is always available when needed.

Limited Product Range: OANDA primarily focuses on forex and CFDs. Traders looking for a broader range of instruments, such as stocks or futures, might find OANDA’s offering limited.

No Local Branches in MENA: While OANDA operates globally, it does not have local branches in the MENA region, which might be a drawback for traders preferring face-to-face interaction.

High Inactivity Fees: OANDA charges an inactivity fee for dormant accounts, which can be a disadvantage for traders who do not trade frequently.

Complex Fee Structure: Some users have reported that OANDA’s fee structure can be somewhat complex and difficult to understand, particularly for beginners.

No Negative Balance Protection in All Jurisdictions: While OANDA offers negative balance protection in some regions, it is not available globally, which could pose a risk for traders in certain areas.

Conclusion

OANDA stands out as a reliable and versatile broker, particularly well-suited for traders in the MENA region. Its competitive pricing, extensive market access, and robust trading platforms make it an attractive choice for both new and experienced traders. While the inactivity fee and limited account options might be drawbacks for some, the overall strengths of OANDA, including its regulatory standing and customer support, make it a broker worth considering.

For traders looking for a transparent and user-friendly trading experience backed by a reputable broker, OANDA is a solid option. Whether you are just starting your trading journey or looking to enhance your trading strategies, OANDA provides the tools and resources needed to succeed in the dynamic world of financial markets.

FAQ

Yes, OANDA is a highly regulated broker. It operates under the supervision of several top-tier regulatory authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the US Commodity Futures Trading Commission (CFTC). In the MENA region, OANDA is regulated by the Dubai Financial Services Authority (DFSA).

OANDA offers the popular MetaTrader 4 (MT4) platform and its proprietary OANDA Trade platform. Both platforms are known for their user-friendly interfaces, advanced charting tools, and comprehensive features, catering to traders of all experience levels.

OANDA provides various account types to suit different trading needs. These include standard accounts and premium accounts, each with its own set of benefits and features. Demo accounts are also available for those who wish to practice trading without risking real money.

OANDA operates on a transparent pricing model with tight spreads. While it does not charge commissions on trades, there are other fees to be aware of, such as overnight financing costs and inactivity fees for dormant accounts.

OANDA supports various methods for depositing and withdrawing funds, including bank transfers, credit/debit cards, and popular e-wallets like PayPal. The availability of these methods may vary based on your region.

Absolutely. OANDA provides a wealth of educational resources designed to help traders improve their skills and knowledge. These include webinars, tutorials, market analysis, and comprehensive guides covering various aspects of trading.

OANDA offers 24/5 customer support via live chat, email, and phone. The support team is known for being responsive and helpful. Additionally, OANDA’s website features an extensive FAQ section and a robust help center to address common queries.