- Founded: 2007

- Headquarters: Seychelles

- Min deposit: 200 USD

- Max Leverage: 1 : 500

IC Markets Global stands as a prominent figure in the online brokerage industry, especially within the MENA region, where it caters to a growing base of traders and investors looking for reliable and efficient trading services. Known for its robust trading platforms and competitive pricing, IC Markets Global offers a comprehensive trading environment that is well-suited to both novice and experienced traders. This review will cover all aspects of their service, from trading options to customer support, fees, and more, to give you a thorough overview of what IC Markets Global has to offer.

Company Overview

Founded in the early 2000s, IC Markets Global has expanded its reach to serve clients globally, with a strong focus on the MENA region. It is regulated by several top-tier financial authorities, ensuring a high standard of operational integrity and security. The broker is known for its deep liquidity pools, which result from relationships with major financial institutions, providing clients with a high-quality trading experience characterized by tight spreads and minimal slippage.

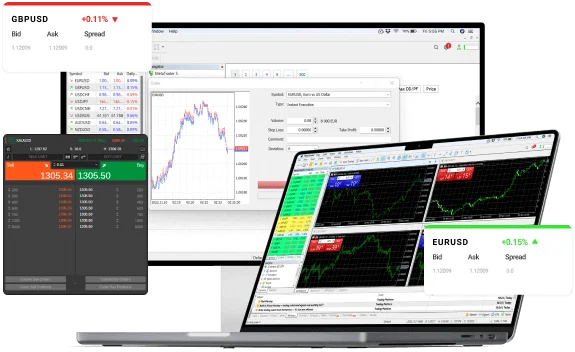

Trading Platforms

MetaTrader 4 (MT4)

IC Markets Global offers the highly acclaimed MetaTrader 4 platform, which remains a favorite among Forex traders worldwide. MT4 is renowned for its user-friendly interface, advanced charting tools, automated trading capabilities, and extensive back-testing environment. Traders can customize their trading experience with a vast selection of technical indicators and graphical objects, making it suitable for strategies of all complexities.

MetaTrader 5 (MT5)

As the successor to MT4, MetaTrader 5 offers all the beloved features of its predecessor but with additional capabilities. MT5 supports trading in stocks, futures, and Forex, providing traders with more financial instruments to diversify their portfolios. Enhanced order management systems and improved processing speeds make MT5 an excellent choice for traders looking for a multi-asset platform.

cTrader

IC Markets Global also provides access to cTrader, known for its sleek interface and advanced order capabilities. cTrader is particularly favorable for scalpers and day traders due to its ultra-fast execution speeds and direct market access. The platform also features detachable charts, level II pricing, and one-click trading.

Each platform is available on desktop, web, and mobile applications, ensuring traders can monitor and execute trades from anywhere at any time.

Tradable Assets

IC Markets Global offers an impressive range of tradable assets that cater to a wide variety of investors:

Forex: Traders have access to over 60 currency pairs, including major, minor, and exotic pairs, facilitating a global trading experience.

Commodities: The broker provides a variety of commodities for trading, such as oil, gold, and silver, which are traditionally used for hedging against inflation or currency devaluation.

Indices: Clients can trade on global indices, which include S&P 500, FTSE 100, and other significant indices.

Stocks: A broad selection of stocks from major exchanges is available, allowing traders to take positions in their favorite companies.

Cryptocurrencies: For those interested in the burgeoning field of digital currencies, IC Markets Global offers trading in major cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

This extensive selection enables traders to diversify their portfolios and access various markets from a single platform.

Account Types

IC Markets Global provides three main types of accounts to accommodate the needs of different traders:

Standard Account: This account type is ideal for entry-level traders with no commissions on trades; instead, spreads start from 1 pip. The Standard Account offers access to all trading platforms and a wide range of tradable assets.

Raw Spread Account: Aimed at more experienced traders, the Raw Spread Account features lower spreads starting from 0.0 pips. Traders pay a fixed commission per trade, which can be more cost-effective for those trading large volumes or frequent scalping.

cTrader Account: This account type is tailored for users of the cTrader platform and provides spreads from 0 pips with a commission per trade. It’s designed for advanced traders who require rapid execution speeds and more sophisticated trading tools.

Deposits and Withdrawals

Ease of Transactions: IC Markets Global ensures a smooth transaction process for its clients in the MENA region. Deposits can be made using a variety of methods including major credit cards, wire transfers, and e-wallets such as PayPal, Neteller, and Skrill. Additionally, they support local payment options, which is a boon for traders in this region, reducing the hassle of currency conversions and associated fees.

Speed of Processing: Deposits are generally processed instantaneously, especially when made through e-wallets or credit cards, allowing traders to take advantage of trading opportunities without delay. Withdrawals are equally efficient; requests are typically processed within 24 hours, though the funds may take a few days to reflect in your account depending on the withdrawal method chosen.

Security Measures: IC Markets Global prioritizes the safety of its clients’ funds with stringent security measures in place. All transactions are encrypted with the latest technology, and the broker adheres to strict regulatory guidelines to ensure financial security and transparency.

Fees and Costs

Competitive Pricing: IC Markets Global is known for its competitive fee structure, which is particularly attractive in the MENA markets. The broker operates with a low spread model, often starting from 0.0 pips on major currency pairs, which is beneficial for Forex traders looking for cost-effective trading.

Commission and Non-trading Fees: For those opting for the cTrader platform, there is a commission per trade, which is clearly outlined on their site, ensuring transparency. However, it’s noteworthy that IC Markets Global does not impose an inactivity fee, which is a common pitfall with some brokers, making it an economical choice for traders who might not be consistently active.

Leverage Costs: Leverage options are quite flexible at IC Markets Global, but it’s important for traders to be aware of the costs associated with high leverage, which can amplify both profits and losses. The broker provides detailed guidelines to help traders make informed decisions about leveraging their positions.

Education and Resources

Comprehensive Educational Materials: IC Markets Global excels in providing an array of educational resources that cater to both beginners and experienced traders. Their offerings include detailed articles, tutorial videos, and webinars on a range of topics from the basics of Forex trading to advanced technical analysis techniques.

Research Tools and Insights: Traders in the MENA region can benefit from IC Markets Global’s in-depth market analysis and research tools. These resources are designed to help traders make well-informed decisions. Regular market updates and insights are provided, ensuring traders are well-equipped to navigate the markets effectively.

Demo Account Facility: One of the standout features of IC Markets Global is the provision of a risk-free demo account. This allows new traders to practice their trading strategies without any financial risk and helps seasoned traders test out new techniques before applying them in live markets.

Customer Support

Responsiveness: IC Markets Global offers a robust customer support system that is accessible 24/7 through live chat, email, and phone. The response time is commendably quick, with live chat and phone inquiries typically answered within a few minutes. Email responses are thorough and are usually received within a few hours.

Languages: Reflecting the diverse linguistic landscape of the MENA region, support is available in multiple languages including Arabic, English, and French, which facilitates easier communication and enhances user experience for traders from different backgrounds.

Quality of Assistance: The customer support team at IC Markets Global is knowledgeable and well-equipped to handle a wide range of issues from account queries to technical support. The support personnel are trained to provide detailed and helpful advice that caters to both novice and experienced traders.

Security

Regulation: IC Markets Global is rigorously regulated by several top-tier authorities, ensuring a high standard of operational compliance. This includes oversight from the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), which are known for their strict regulatory standards.

Data Security: The brokerage uses advanced security technologies, including SSL encryption to secure user data and transactions. This commitment to cybersecurity is crucial in protecting client funds and personal information from unauthorized access.

Risk Management: IC Markets Global implements several risk management tools, including negative balance protection and segregated client accounts. These measures are critical in safeguarding traders’ capital, especially in volatile trading environments.

User Reviews and Community Trust

User Reviews: Overall, user reviews of IC Markets Global are positive. Many traders commend the platform for its user-friendly interface and the wide range of trading tools available. However, some users have noted issues with account verification times during periods of high demand.

Community Trust: IC Markets Global has built a solid reputation within the MENA trading community. The broker is known for its transparent trading conditions and reliable execution. It has also participated in various regional financial expos and seminars, further solidifying its presence and commitment to the MENA markets.

Pros and Cons

- Extensive Range of Instruments: Traders have access to a wide array of trading instruments including forex, commodities, stocks, and indices.

- Competitive Spreads and Fees: IC Markets Global offers some of the most competitive spreads and trading fees in the industry, which is a major draw for cost-conscious traders.

- Advanced Trading Platforms: The broker provides access to both MetaTrader 4 and MetaTrader 5 platforms, as well as cTrader, catering to all levels of trading experience.

- Educational Resources: There is a wealth of educational materials available, from webinars to in-depth articles and trading guides, which are great for both beginners and experienced traders.

- Account Verification Delays: Some users have reported delays in the account verification process, which can be a setback for new traders eager to start trading.

- Withdrawal Fees: There are fees associated with some withdrawal methods, which might be a drawback for traders who operate with smaller account sizes.

Conclusion

IC Markets Global is a formidable option for traders in the MENA region seeking a reliable, well-regulated broker that offers a diverse range of trading instruments and platforms. With competitive fees, comprehensive educational resources, and robust customer support, IC Markets Global caters well to both new and experienced traders. Whether you are looking to trade forex, stocks, or any other financial instrument, IC Markets Global provides a professional and secure environment to meet your trading needs.

FAQ

IC Markets Global offers several types of trading accounts tailored to different trader needs, including Standard, Raw Spread, and Islamic swap-free accounts. The Standard account typically involves no commission with slightly higher spreads, while the Raw Spread account features lower spreads with a commission per trade.

Yes, IC Markets Global is suitable for beginners. The platform offers a range of educational resources, including trading guides, webinars, and demo accounts, which are ideal for new traders looking to gain experience without financial risk.

IC Markets Global prioritizes client security through multiple measures. It is regulated by reputable authorities like ASIC and CySEC, uses SSL encryption for data protection, and holds client funds in segregated accounts separate from its corporate funds.

Yes, IC Markets Global provides cryptocurrency trading among its offerings. Traders can engage in cryptocurrency trading alongside forex, commodities, stocks, and indices, using any of the available platforms such as MetaTrader 4, MetaTrader 5, or cTrader.

IC Markets Global charges different fees depending on the account type. For Standard accounts, the broker charges no commission but spreads start from 1 pip. For Raw Spread accounts, there is a commission per trade, but spreads can be as low as 0 pips. Additionally, there may be fees for withdrawals depending on the payment method used.

Withdrawal times at IC Markets Global can vary based on the method used. Typically, withdrawals to e-wallets are processed within 24 hours, while bank transfers may take several business days.

Yes, IC Markets Global provides customer support in multiple languages, including Arabic. This is particularly beneficial for MENA region traders who prefer assistance in their native language.