- Founded: 2007

- Headquarters: Limassol, Cyprus

- Min deposit: 200 USD

- Max Leverage: 1 : 400

In the dynamic world of online trading, eToro stands out as a popular choice among investors, especially in the MENA region. This review will cover all aspects of eToro’s services, from its trading platform and range of financial products to customer support, fees, and regulatory compliance. Whether you are a novice trader or a seasoned investor, this review aims to provide you with comprehensive insights into what eToro has to offer.

Company Overview

eToro was established in 2007 with the vision of opening up the global markets for everyone to trade and invest in a simple and transparent way. The company has since grown to serve millions of users worldwide with an innovative platform that combines traditional asset trading with social and copy trading features. eToro is particularly favored in the MENA region for its user-friendly interface and diverse market offerings.

Trading Platforms

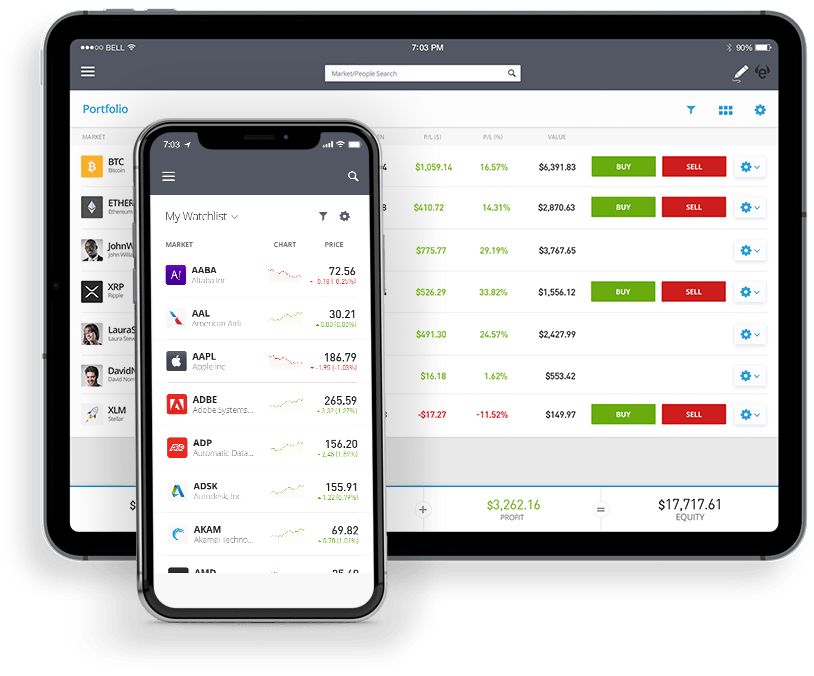

- User-Friendly Interface: eToro’s trading platform is renowned for its user-friendly interface, which makes it exceptionally suitable for new traders. The design is clean and intuitive, ensuring that users can navigate through the site with ease. One of the standout features is the social trading component, which allows users to follow and copy the trades of successful investors. This feature is integrated seamlessly into the platform, providing a unique blend of social networking and trading.

- Web and Mobile Accessibility: eToro offers a responsive web platform and a highly rated mobile app available on both iOS and Android, allowing traders to manage their investments on the go. The mobile app mirrors the functionality of the desktop version, ensuring a seamless transition between devices. Real-time alerts, one-tap operations, and a customizable dashboard make the mobile experience robust and convenient for traders who prefer mobile access.

- Tools and Features: The platform includes an array of trading tools that enhance the trading experience. Technical analysis tools, graphical representations, and historical data are readily available. eToro also integrates economic calendars, earnings reports updates, and news feeds directly into the platform, helping traders make informed decisions based on the latest market trends and events.

Tradable Assets

eToro offers a diverse range of tradable assets that makes it appealing to a broad spectrum of traders. Clients can trade in major asset classes including:

- Stocks & ETFs: Traders can buy shares of leading companies and ETFs without paying commission, which includes access to international markets.

- Forex: With a wide variety of currency pairs, eToro provides ample forex trading opportunities.

- Cryptocurrencies: eToro is one of the leading brokers for cryptocurrency trading, offering a variety of cryptocurrencies for trading or investment.

- Commodities and Indices: Traders also have access to commodities like gold, oil, and natural gas, as well as major indices.

Social Trading Features:

Apart from standard trading options, eToro offers an innovative feature called CopyTrading. This allows users to replicate the positions of other traders automatically, which is particularly useful for those new to the trading world or those looking to leverage the experience of seasoned traders.

Account Types

For those looking to explore the platform without financial risk, eToro offers a demo account loaded with a virtual fund. This account allows traders to practice strategies and get accustomed to the platform’s features without using real money.

Retail Account: The standard retail account provides access to all trading platforms and a vast range of instruments with competitive spreads. The account setup is straightforward, requiring a minimum deposit that varies depending on the region but is generally accessible.

Professional Account: For more experienced traders who can meet certain criteria, eToro offers a professional account. This account type provides additional features like higher leverage and access to more sophisticated trading tools, although it comes with a higher risk level.

Islamic Account: Understanding the needs of traders in the MENA region, eToro offers an Islamic account option, which complies with Sharia law. This account type does not incur overnight or rollover interest on positions held overnight, catering specifically to our clients who require it.

Deposits and Withdrawals

Fees and Costs

Education and Resources

Customer Support

Security

User Reviews and Community Trust

Pros and Cons

- Social Trading Platform: eToro revolutionizes the trading experience by integrating social networking features, allowing users to share strategies, copy trades, and discuss market trends.

- Regulation and Security: With top-tier regulation, eToro offers a secure trading environment, which is a critical factor when handling investments.

- User-Friendly Interface: The platform is designed to be intuitive, catering to both beginners and experienced traders, which is evident from the streamlined navigation and detailed yet clear asset information.

- Diverse Trading Instruments: eToro offers a broad array of financial instruments, including stocks, cryptocurrencies, forex, commodities, and ETFs, allowing traders to diversify their portfolios extensively.

- Withdrawal and Non-Trading Fees: While eToro offers free stock trading, it imposes a withdrawal fee and other non-trading fees, which might accumulate and affect profitability.

- Spread Costs: The spread costs on eToro, particularly for cryptocurrencies and certain other assets, can be higher compared to other brokers.

- Limited Advanced Tools for Professional Traders: Although perfect for beginners and intermediate traders, eToro’s analytical tools might not satisfy the demands of highly experienced traders looking for in-depth technical analysis.

Conclusion

eToro offers a compelling choice for traders and investors in the MENA region due to its user-friendly platform, innovative social trading features, and broad range of available assets. While its fee structure and customer service responsiveness could be improved, the overall trading experience it offers is of high quality. Newcomers to trading, in particular, may find eToro’s educational resources and community-driven approach beneficial.

For those considering trading with eToro, it may be wise to start with their demo account to get familiar with the platform’s features and fee structure. With its regulatory framework and innovative trading tools, eToro remains a solid choice for both new and experienced traders in the MENA region.

FAQ

Yes, eToro operates in many countries across the MENA region. However, availability can vary by specific country due to local regulations, so it’s recommended to check the eToro website or contact their customer support to confirm availability in your specific location.

eToro takes the security of its users’ assets seriously by implementing several robust measures:

- SSL encryption is used on all data transfers.

- Two-factor authentication (2FA) adds an extra layer of security.

- eToro is regulated by several authorities worldwide, including the FCA, CySEC, and ASIC, ensuring compliance with financial services standards.

eToro does not charge a commission for stock trading. However, there are other fees to consider, such as withdrawal fees, inactivity fees, and spread charges on trades. Spreads can vary by asset class, and it’s important to review these before executing trades on the platform.

Yes, eToro offers a demo account feature that allows new users to practice trading with virtual money. This can be an excellent way for potential investors to familiarize themselves with the platform and test different trading strategies without any risk.

CopyTrading is a feature that allows users to allocate funds to replicate another investor’s portfolio and trading activity automatically. When the copied trader makes a trade, the same trade is executed at a proportional level in your account.

eToro offers a wide range of trading instruments, including stocks, Forex, cryptocurrencies, ETFs, and commodities. This diversity allows traders to spread their investments across various asset classes according to their risk tolerance and investment goals.

Withdrawal times can vary depending on the method used but typically take about 3-8 business days. eToro also requires account verification, which can affect the withdrawal process, so it’s wise to complete all required identity verification steps well before making a withdrawal.