- Founded: 2011

- Headquarters: UAE

- Min deposit: 100 USD

- Max Leverage: 1 : 500

Welcome to our comprehensive review of ADSS, a prominent brokerage firm catering to traders and investors in the MENA region. Founded in 2011, ADSS has quickly risen to become a respected name in the world of online trading, offering a wide array of financial products and services. This review aims to cover all aspects of trading with ADSS, from its platform options and asset offerings to customer support, fees, and regulatory compliance.

Overview of ADSS

ADSS is headquartered in Abu Dhabi, UAE, and is regulated by the Central Bank of the UAE. It operates globally, providing services to individual and institutional clients. ADSS stands out for its robust trading technology, diverse market access, and a commitment to providing educational resources to traders at all levels.

Trading Platforms

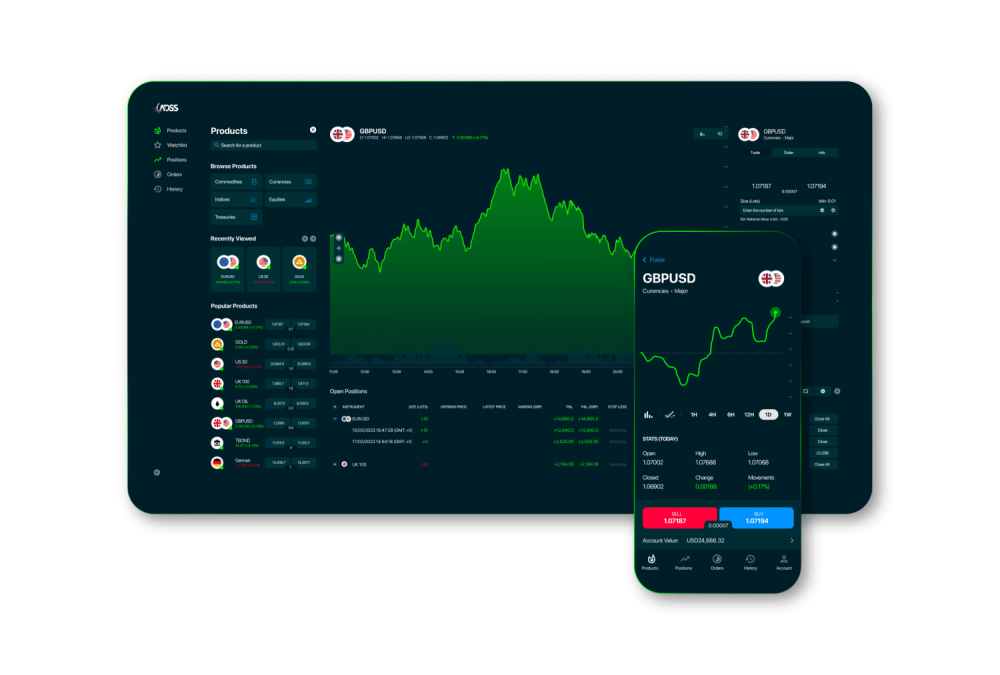

OREX Platform:

ADSS offers its proprietary trading platform, OREX, developed to meet the specific needs of modern traders. OREX stands out for its intuitive design and user-friendly interface, making it suitable for both novices and seasoned traders. The platform offers a seamless trading experience with fast execution speeds, which is crucial for day trading and scalping strategies. Additionally, OREX is available across multiple devices, including desktop and mobile applications, ensuring traders can manage their investments on-the-go.

MetaTrader 4 (MT4):

Recognizing the popularity and robust capabilities of MetaTrader 4, ADSS provides this renowned platform to its clients. MT4 is favored for its advanced charting tools, extensive range of technical indicators, and automated trading capabilities through Expert Advisors (EAs). The platform’s flexibility and depth make it an excellent choice for traders who require comprehensive analytical tools and a customizable trading environment.

Both platforms support a range of order types and offer real-time data feeds, which are essential for making timely and informed trading decisions.

Tradable Assets

ADSS caters to diverse trading preferences by offering a broad spectrum of tradable assets:

Forex: Traders can access a wide range of currency pairs, including major, minor, and exotic pairs. Forex trading with ADSS is enhanced by competitive spreads and leverage up to 500:1, which can maximize potential returns but also increases risk.

Commodities: Those interested in commodities trading will find a variety of options such as gold, silver, oil, and other soft commodities. Trading commodities with ADSS allows traders to diversify their portfolios and hedge against market volatility.

Indices & Stocks: ADSS provides the opportunity to trade on global indices and a selection of international stocks. This is particularly appealing for traders looking to tap into the equity markets without the need for large capital outlays, thanks to the leverage offered.

Bonds and Cryptocurrencies: Although not as extensive as other asset classes, ADSS does offer trading on a select group of government bonds and major cryptocurrencies, providing further portfolio diversification options.

Account Types

ADSS understands that traders have varying needs and investment sizes, which is reflected in their tailored account types:

- Classic Account: designed for entry-level traders, the Classic Account requires a minimum deposit of $100. It offers spreads starting from 1.6 pips on major forex pairs. This account type provides access to both OREX and MT4 platforms and includes basic educational resources and support.

- Elite Account: targeting more experienced traders, the Elite Account demands a higher minimum deposit but rewards users with tighter spreads – starting from 0.6 pips. Clients also benefit from a dedicated account manager, advanced charting tools, and complimentary VPS hosting services, enhancing their trading strategy execution.

- Islamic Account: ADSS respects the unique needs of Muslim traders by offering Sharia-compliant Islamic Accounts, which operate under the principles of no swap or rollover interest on overnight positions. This account type is popular in the MENA region and adheres to Islamic finance principles.

Deposits and Withdrawals

Fees and Costs

Education and Resources

Support for MENA Traders

Customer Support

Security

User Reviews and Community Trust

Pros and Cons

- Regulated by the Central Bank of the UAE: Ensures compliance with high financial standards.

- Multi-lingual Customer Support: Accessible and knowledgeable support team available in several languages.

- Competitive Spreads: Offers some of the best spreads in the region, especially for major currency pairs.

- Robust Educational Resources: Provides a variety of educational tools and resources, beneficial for new traders.

- Advanced Security Measures: Uses top-tier encryption and verification processes to secure user data and funds.

- Platform Design: Some users may find the platform interface to be less modern than competitors.

- Basic Educational Materials for Advanced Traders: The available educational resources are not tailored to meet the needs of highly experienced traders.

Conclusion

ADSS is a reputable broker that offers a secure and comprehensive trading environment suited for traders at all levels. Its commitment to education, customer service, and providing a robust trading platform makes it a strong choice for traders in the MENA region and beyond. Whether you are looking to trade forex, CFDs, or other financial instruments, ADSS provides a solid, regulated platform to meet diverse trading needs.

For traders seeking a reliable and sophisticated broker in the MENA region, ADSS certainly deserves consideration. Always remember to consider your investment objectives and consult with financial advisors to ensure that you are making informed trading decisions.

FAQ

Yes, ADSS is regulated by the Central Bank of the UAE, ensuring it adheres to strict financial and operational standards. This regulation helps to safeguard the interests of its clients and maintain the integrity of its trading operations.

ADSS offers several types of trading accounts to cater to different levels of traders, including a standard account, an elite account for more experienced traders, and Islamic accounts that comply with Sharia law. Each account type has different features and benefits, such as lower spreads and commission rates for higher account tiers.

Yes, ADSS provides the ability to trade various cryptocurrencies in addition to forex, stocks, commodities, and indices. This allows traders to diversify their investment portfolios within the same trading platform.

ADSS offers trading on multiple platforms, including the popular MetaTrader 4 (MT4), the newer MetaTrader 5 (MT5), and its proprietary OREX platform. Each platform is equipped with various tools and features to suit different trading styles and preferences.

ADSS supports multiple methods for deposits and withdrawals, including bank wire transfers, credit/debit cards, and several e-wallets. The broker has streamlined these processes to ensure they are as quick and seamless as possible, though some methods may have longer processing times than others.

ADSS provides 24/5 customer support with multiple channels, including email, live chat, and phone support. Support services are available in several languages, which is particularly beneficial for traders in the diverse MENA region.

Yes, ADSS offers a demo account option that allows new traders to practice trading without risking real money. This is an excellent way to familiarize oneself with ADSS’s trading platforms and tools before committing to live trading.