- Founded: 2001

- Headquarters: UK

- Min deposit: 1 USD

- Max Leverage: 1 : 30

Admiral Markets is a well-established brokerage firm that has gained a solid reputation for providing comprehensive trading services globally, including in the MENA region. Known for its diverse product offerings, competitive spreads, and robust trading platforms, Admiral Markets appeals to both novice and experienced traders. This review delves into the key aspects of Admiral Markets to help you determine whether it aligns with your trading needs.

About

Founded in 2001, Admiral Markets has grown to become a significant player in the online brokerage industry. The broker offers a wide range of trading instruments, including Forex, CFDs on indices, commodities, stocks, bonds, and cryptocurrencies. Admiral Markets is regulated by several top-tier financial authorities, ensuring a high level of trust and security for its clients.

Trading Platforms

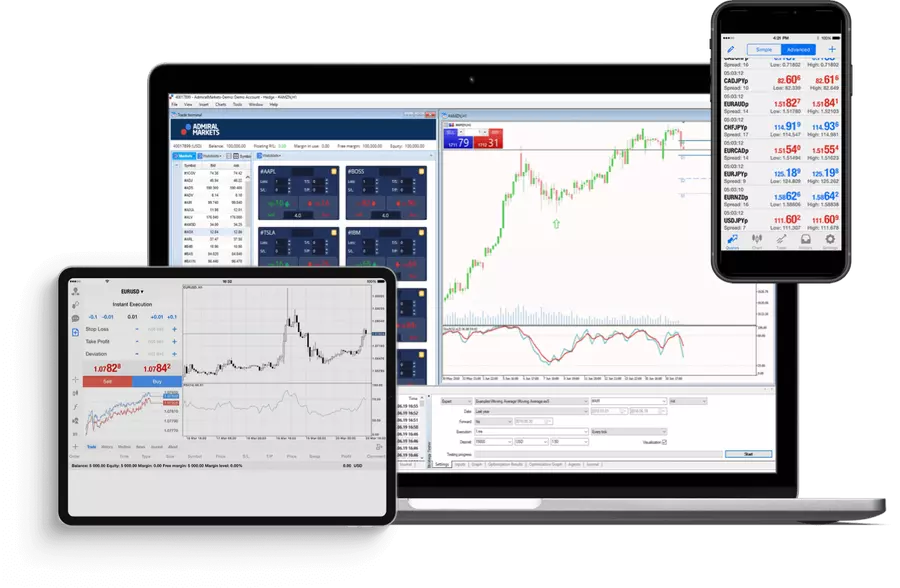

Admiral Markets provides its clients with access to some of the most sophisticated trading platforms available in the industry. These platforms are designed to enhance the trading experience by offering a range of tools and features that cater to different trading styles and strategies.

MetaTrader 4 (MT4)

MetaTrader 4 is one of the most popular trading platforms globally, and Admiral Markets offers a fully optimized version of it. MT4 is known for its user-friendly interface, making it an ideal choice for beginners. It offers a variety of features including advanced charting tools, numerous technical indicators, and automated trading capabilities through Expert Advisors (EAs). The platform is available on desktop, web, and mobile, ensuring that traders can access the markets from anywhere at any time.

MetaTrader 5 (MT5)

For traders seeking more advanced features, MetaTrader 5 is the platform of choice. MT5 offers all the functionalities of MT4, with additional tools and improved performance. It supports a greater number of order types, a built-in economic calendar, and more advanced charting capabilities. MT5 also allows for trading a wider range of asset classes, making it suitable for traders looking to diversify their portfolios.

MetaTrader Supreme Edition

Admiral Markets enhances the capabilities of both MT4 and MT5 with its MetaTrader Supreme Edition. This custom add-on includes advanced features such as the Global Opinion widgets, a correlation matrix, and an advanced trading simulator. These tools provide traders with a deeper level of market analysis and improved risk management options.

Tradable Assets

Admiral Markets offers a comprehensive selection of tradable assets, ensuring that traders have access to a diverse range of financial instruments. This wide selection caters to different trading strategies and risk appetites.

Forex

Forex trading is at the core of Admiral Markets’ offerings. Clients can trade over 40 currency pairs, including major, minor, and exotic pairs. The broker provides competitive spreads and leverage options, making it an attractive choice for forex traders.

Indices

Traders looking to speculate on the performance of global stock indices can choose from a variety of options including the S&P 500, NASDAQ 100, FTSE 100, and many more. Indices trading allows for diversification and can be a less volatile option compared to individual stocks.

Commodities

Commodities trading is another strong suit of Admiral Markets. Traders can access a range of commodities including precious metals like gold and silver, energy products such as crude oil, and agricultural commodities. This provides opportunities for traders looking to hedge against inflation or diversify their portfolios.

Stocks and ETFs

Admiral Markets offers access to thousands of stocks and ETFs from global markets. Traders can invest in leading companies from the US, Europe, and Asia. The availability of fractional shares allows for more flexible investment options, making it possible to invest in high-value stocks with smaller capital.

Cryptocurrencies

For traders interested in the burgeoning cryptocurrency market, Admiral Markets offers a selection of popular digital currencies including Bitcoin, Ethereum, and Litecoin. Cryptocurrencies can be traded as CFDs, allowing traders to speculate on price movements without owning the underlying assets.

Account Types

Admiral Markets provides a variety of account types to suit different trading needs and experience levels. Each account type comes with its own set of features and benefits.

-

Admiral Markets Account

This is the standard account offering, suitable for most traders. It provides access to a wide range of instruments including forex, indices, commodities, and cryptocurrencies. The account features competitive spreads and no commission on forex and metals. It also supports both MT4 and MT5 platforms.

-

Admiral Prime Account

The Admiral Prime Account is designed for traders who require tighter spreads and are willing to pay a commission per trade. This account type is ideal for high-frequency traders and those using advanced trading strategies. It offers the best possible trading conditions for forex and metals, with access to both MT4 and MT5 platforms.

-

Admiral Invest Account

For those focused on investing in stocks and ETFs, the Admiral Invest Account is the perfect choice. It allows for the purchase of physical stocks and ETFs with competitive commission rates. This account does not support leverage, making it suitable for long-term investors.

-

Admiral MT5 Account

This account type is tailored for traders who prefer the MetaTrader 5 platform exclusively. It offers access to all asset classes available on MT5, including stocks, ETFs, and cryptocurrencies. The account features competitive spreads and no commission on forex and metals.

-

Islamic Account

Admiral Markets also caters to clients who require Sharia-compliant trading accounts. The Islamic Account option is available on the Admiral Markets and Admiral MT5 accounts, offering swap-free trading without incurring interest charges, making it compliant with Islamic finance principles.

Deposits and Withdrawals

- Bank Transfers: Admiral Markets supports bank transfers from a wide range of local banks in the MENA region. This method, while secure, can take 1-3 business days for the funds to reflect in your trading account.

- Credit/Debit Cards: Visa and MasterCard are accepted, providing a quick and easy way to fund your account. Deposits via card are usually instant.

- E-Wallets: Popular e-wallets such as Skrill, Neteller, and PayPal are supported, allowing for instant deposits. These methods are particularly favored for their speed and convenience.

- Local Payment Solutions: The broker also supports various local payment methods specific to different countries in the MENA region, ensuring accessibility for all traders.

- Bank Transfers: Withdrawals via bank transfer can take 1-5 business days depending on the bank and country. This method is reliable but slower compared to other options.

- Credit/Debit Cards: Withdrawals to credit or debit cards are generally processed within 1-3 business days.

- E-Wallets: Withdrawals to e-wallets like Skrill and Neteller are typically processed within 24 hours, making them a preferred choice for traders who need quick access to their funds.

- Local Payment Solutions: Just as with deposits, Admiral Markets supports various local withdrawal methods to ensure convenience for traders in the MENA region.

- Admiral Markets does not charge fees for deposits or withdrawals, but be aware that your bank or payment provider might levy some charges.

Fees and Costs

Understanding the fee structure is crucial for any trader, and Admiral Markets offers a transparent approach to its pricing.

Spreads:

Admiral Markets operates with variable spreads. For instance, the typical spread for the EUR/USD pair starts from 0.5 pips, which is competitive compared to other brokers in the MENA region. However, spreads can vary depending on market conditions and the type of account you hold.

Commissions:

The broker offers several account types, including Trade.MT5 and Zero.MT5 accounts. The Trade.MT5 account primarily charges through spreads, with no additional commissions on forex and CFDs. In contrast, the Zero.MT5 account offers raw spreads starting from 0 pips but charges a commission based on trading volume, which can be advantageous for high-volume traders seeking the tightest spreads.

Overnight Fees:

Admiral Markets charges overnight fees (swap rates) for positions held overnight. These fees can vary depending on the instrument and market conditions. It’s essential to check the swap rates on the broker’s platform as they are updated regularly.

Inactivity Fees:

An inactivity fee is charged if there has been no trading activity for 24 months. The fee is $10 per month until the account balance reaches zero.

Other Costs:

Admiral Markets does not charge for account maintenance, making it an affordable option for traders who are just starting or those who are mindful of additional costs.

Education and Resources

Admiral Markets stands out in the MENA region for its extensive educational resources and support, designed to help traders of all levels enhance their skills and knowledge.

Educational Materials:

- Webinars and Seminars: Regularly scheduled webinars cover various topics such as market analysis, trading strategies, and platform tutorials. These are conducted by experienced traders and market analysts. Additionally, the broker occasionally hosts seminars in the MENA region, providing face-to-face learning opportunities.

- Articles and Tutorials: The broker’s website features a comprehensive library of articles and tutorials that cover everything from the basics of trading to advanced strategies. This content is accessible to all registered users.

- Video Tutorials: Step-by-step video guides on using the Admiral Markets trading platforms, including MetaTrader 4 and MetaTrader 5, are available. These videos are particularly useful for beginners who need visual guidance.

Market Analysis:

Admiral Markets offers daily market analysis and news updates, which are essential for staying informed about market movements. This includes technical and fundamental analysis provided by professional analysts.

Trading Tools:

- Admiral Markets Supreme Edition: This is an exclusive plugin for MetaTrader 4 and 5 that provides additional tools and indicators to enhance your trading experience. It includes advanced charting tools, trading analytics, and sentiment indicators.

- Economic Calendar: An economic calendar is available to help traders keep track of important economic events and announcements that could impact the markets.

- Trading Calculators: Various calculators, such as the margin calculator, pip calculator, and currency converter, are available to help traders manage their positions and assess potential risks and rewards.

Customer Support:

Admiral Markets provides excellent customer support available 24/5 via live chat, email, and phone. Support is available in multiple languages, including Arabic, catering specifically to traders in the MENA region.

Customer Support

Customer support is a cornerstone of Admiral Markets’ services, reflecting their commitment to providing a seamless trading experience. Available through multiple channels, including live chat, email, and phone, Admiral Markets’ support team is responsive and well-informed.

Availability and Responsiveness

One of the standout features of Admiral Markets’ customer support is its availability. The support team is accessible 24/5, which aligns with the global trading week and ensures that traders can get assistance during market hours. This is particularly beneficial for traders in the MENA region, as it covers different time zones effectively.

Multilingual Support

Understanding the diverse linguistic needs of the MENA region, Admiral Markets offers multilingual support. This includes Arabic, ensuring that traders can communicate in their preferred language, which greatly enhances the user experience.

Knowledge and Professionalism

The support team at Admiral Markets is known for its professionalism and expertise. Whether dealing with technical issues, account inquiries, or trading-related questions, the team provides clear and precise guidance. The comprehensive FAQ section and educational resources on their website further supplement their support services, empowering traders with the knowledge to solve issues independently.

Security

Security is a paramount concern for traders, and Admiral Markets takes extensive measures to ensure that its clients’ funds and data are protected.

Regulation and Compliance

Admiral Markets is regulated by several reputable financial authorities, including the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). This multi-tiered regulation framework provides a high level of security and compliance, reassuring traders of the broker’s legitimacy and commitment to maintaining industry standards.

Data Protection

The broker employs advanced encryption technologies to safeguard personal and financial data. Admiral Markets uses Secure Socket Layer (SSL) encryption to ensure that all transactions and communications are secure. Additionally, they adhere to stringent data protection policies that comply with international standards.

Fund Security

Admiral Markets keeps client funds in segregated accounts, separate from the company’s operational funds. This segregation ensures that client funds are protected even in the unlikely event of the broker’s insolvency. Moreover, Admiral Markets participates in compensation schemes such as the Financial Services Compensation Scheme (FSCS) in the UK, which provides an additional layer of security for traders’ funds.

User Reviews and Community Trust

User reviews and community trust are crucial indicators of a broker’s reliability and reputation. Admiral Markets has generally positive feedback from its user base, which reflects its strong performance and trustworthy services.

Positive User Experiences

Many users commend Admiral Markets for its intuitive trading platform and comprehensive range of trading instruments. The MetaTrader 4 and MetaTrader 5 platforms, which Admiral Markets offers, are particularly praised for their user-friendly interfaces and advanced trading tools. Traders appreciate the seamless execution of trades, the availability of various analytical tools, and the overall reliability of the platform.

Educational Resources

Admiral Markets is also highly regarded for its educational resources. They offer a plethora of webinars, articles, and tutorials designed to enhance traders’ knowledge and skills. This commitment to education has built a loyal community of informed traders who value the broker’s efforts to empower them through learning.

Community Trust

Community trust in Admiral Markets is reflected in its strong online presence and positive reviews across various forums and review sites. Traders frequently highlight the transparency of the broker’s operations, from fee structures to trade executions. The transparency in their dealings builds trust and establishes Admiral Markets as a reliable broker in the eyes of the trading community.

Areas for Improvement

While Admiral Markets receives mostly positive reviews, some users have noted areas where improvements could be made. A few traders have mentioned that the account verification process can be time-consuming. However, this is often viewed as a necessary step to ensure compliance with regulatory standards and enhance security.

Additionally, some users have expressed a desire for more localized support in certain regions within MENA. While the multilingual support is extensive, having more localized offices could further improve the responsiveness and tailored support for traders in different countries.

Pros and Cons

- Comprehensive Customer Support

Admiral Markets ensures that traders can get help during market hours with its 24/5 availability. The broker offers support in various languages, including Arabic, enhancing accessibility for traders in the MENA region. Additionally, the support staff is professional and knowledgeable, providing clear, precise, and helpful responses to queries. - Strong Security Measures

Admiral Markets is regulated by multiple authorities, including the FCA, ASIC, and CySEC, which provides high levels of oversight and trust. The broker utilizes advanced data protection technologies like SSL encryption and adheres to international data protection standards. Client funds are kept in segregated accounts, separate from company funds, adding an extra layer of security. - Positive User Reviews and High Community Trust

Users praise the reliability of the MetaTrader 4 and MetaTrader 5 trading platforms for their user-friendly interfaces and advanced trading tools. Admiral Markets offers extensive educational resources, such as webinars, articles, and tutorials, helping traders improve their knowledge and skills. Transparency in communication about fees and operations builds trust among users. - Broad Range of Trading Instruments

Admiral Markets offers a wide range of financial instruments, including Forex, CFDs, commodities, indices, and cryptocurrencies, catering to various trading preferences.

- Lengthy Account Verification Process

Some users find the account verification process longer than expected. However, this is necessary for regulatory compliance and security. - Limited Local Offices in MENA Region

While multilingual support is strong, having more local offices in specific countries within the MENA region could enhance responsiveness and provide more tailored assistance. - Complex Fee Structure

Understanding the full fee structure can be complex and may require careful review of the terms and conditions. - Occasional Platform Downtime

There have been occasional reports of platform downtime for maintenance, which can be inconvenient during trading hours. - Higher Minimum Deposit for Some Accounts

Certain account types require a higher minimum deposit, which may be a barrier for new or smaller-scale traders.

Conclusion

Admiral Markets stands out as a reliable and versatile broker, particularly well-suited for traders in the MENA region. With its wide range of trading instruments, competitive fees, robust trading platforms, and strong regulatory oversight, Admiral Markets provides a comprehensive trading solution for both beginners and experienced traders. The broker’s commitment to education and customer support further enhances its appeal, making it a top choice for those looking to navigate the financial markets confidently.

In summary, Admiral Markets offers a well-rounded trading experience that caters to the diverse needs of its clients. Whether you are a novice trader looking to learn the ropes or an experienced trader seeking advanced tools and competitive pricing, Admiral Markets is worth considering as your brokerage partner in the MENA region.

FAQ

Admiral Markets is a globally recognized broker offering a wide range of financial instruments, including forex, commodities, indices, cryptocurrencies, and stocks. It is known for its robust trading platforms, comprehensive educational resources, and excellent customer support.

Yes, Admiral Markets is regulated by several reputable financial authorities, including:

- The UK’s Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The Cyprus Securities and Exchange Commission (CySEC)

These regulations ensure that Admiral Markets operates within strict guidelines and provides a secure trading environment.

Admiral Markets provides access to two of the most popular trading platforms in the industry:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

Both platforms are available on desktop, web, and mobile devices, offering a range of advanced trading tools, charting capabilities, and automated trading options.

Admiral Markets offers several types of trading accounts to cater to different trading needs:

- Trade.MT4: Ideal for forex and CFD trading on the MetaTrader 4 platform.

- Zero.MT4: Aimed at traders who prefer zero spreads with a commission-based structure on MetaTrader 4.

- Trade.MT5: Suitable for trading on the MetaTrader 5 platform with a broader range of instruments.

- Invest.MT5: Designed for trading real stocks and ETFs on MetaTrader 5.

Each account type comes with its specific features and benefits, catering to various trading styles and preferences.

Admiral Markets is transparent about its fee structure. The fees and commissions depend on the type of account and the financial instrument being traded. While some accounts offer commission-free trading with wider spreads, others feature tighter spreads with a commission fee. It’s important to review the specific fee structure on Admiral Markets’ website for detailed information.

Yes, Admiral Markets is renowned for its extensive educational resources. These include:

- Webinars and seminars

- Educational articles and tutorials

- Trading videos

- Comprehensive guides and eBooks

These resources are designed to help traders of all experience levels improve their trading knowledge and skills.

Admiral Markets offers 24/5 customer support through multiple channels, including live chat, email, and phone. The support team is multilingual, catering to traders in various regions, including those in the MENA region.