- Founded: 2000

- Headquarters: Switzerland

- Min deposit: 1000 USD

- Max Leverage: 1 : 100

Swissquote, a renowned name in the financial services industry, offers a robust trading platform that caters to a wide range of investors. Established in 1996 and headquartered in Switzerland, Swissquote has built a solid reputation for its reliable services, extensive product offerings, and commitment to security. This review delves into the various aspects of Swissquote’s offerings, focusing on its suitability for traders in the MENA region.

About

Swissquote was founded in 1996 and is headquartered in Switzerland. Over the years, it has grown into one of the leading online financial and trading services providers, serving clients globally, including those in the MENA region. The broker is regulated by top-tier financial authorities, including the Swiss Financial Market Supervisory Authority (FINMA) and the Financial Conduct Authority (FCA) in the UK, ensuring a high level of trust and security for its clients.

Swissquote’s mission is to make trading accessible to everyone by offering innovative solutions and a wide array of financial products. It prides itself on its transparency, reliability, and cutting-edge technology, catering to both retail and institutional investors.

Trading Platforms

Swissquote offers a variety of trading platforms to suit different types of traders. Each platform is designed with user experience in mind, providing robust tools and features to enhance trading efficiency and effectiveness.

- Advanced Trader: This is Swissquote’s proprietary platform, designed for both beginners and experienced traders. It offers a user-friendly interface, advanced charting tools, real-time market data, and customizable dashboards. The platform is accessible via desktop, web, and mobile applications, ensuring you can trade on the go.

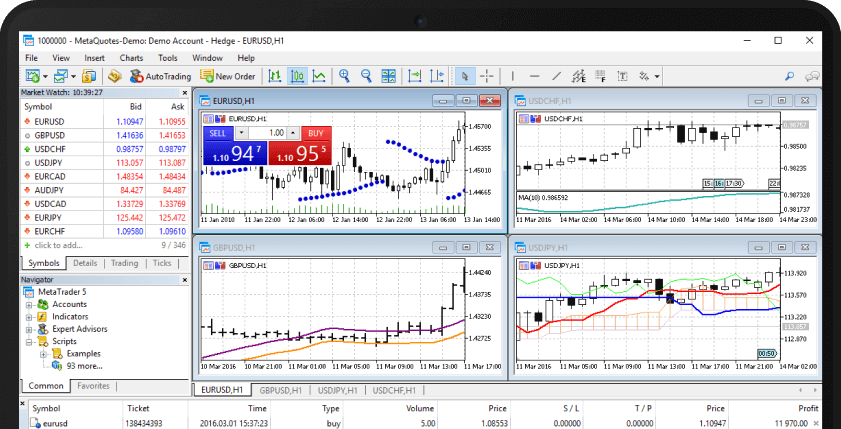

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5): Swissquote supports both MT4 and MT5, the industry-standard trading platforms renowned for their advanced analytical tools, automated trading capabilities, and a wide range of technical indicators. These platforms are ideal for traders who prefer a more sophisticated trading environment with extensive customization options.

- Swissquote Robo-Advisory: For those looking for a more hands-off approach to investing, Swissquote offers a Robo-Advisory service. This platform uses sophisticated algorithms to manage and optimize your portfolio based on your risk profile and investment goals.

Tradable Assets

One of Swissquote’s standout features is its extensive range of tradable assets. This variety allows traders to diversify their portfolios and take advantage of different market opportunities.

Forex: Swissquote provides access to over 80 currency pairs, offering competitive spreads and leverage options. This makes it a great choice for forex traders looking for both major and exotic currency pairs.

Stocks: Investors can trade a vast array of stocks from major global exchanges, including the New York Stock Exchange (NYSE), NASDAQ, London Stock Exchange (LSE), and more. Swissquote offers both direct stock trading and CFD trading, providing flexibility depending on your investment strategy.

Commodities: Swissquote offers trading in various commodities such as gold, silver, oil, and agricultural products. This enables traders to hedge against market volatility and diversify their portfolios.

Indices: Traders can invest in major global indices like the S&P 500, NASDAQ 100, FTSE 100, and DAX 30. Swissquote’s indices trading includes both cash and futures contracts, catering to different trading preferences.

Cryptocurrencies: Swissquote has embraced the digital currency revolution, offering trading in popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. This makes it an attractive option for traders looking to venture into the burgeoning crypto market.

ETFs and Funds: Swissquote provides access to a wide range of Exchange-Traded Funds (ETFs) and mutual funds. This is ideal for investors looking for diversified investment options with varying risk levels.

Account Types

Swissquote offers several account types tailored to meet the diverse needs of its clients. Each account type provides different features and benefits, ensuring that traders can find one that suits their specific trading style and goals.

Standard Account: This is the basic account type suitable for retail traders. It offers competitive spreads, access to all trading platforms, and a minimum deposit requirement that is accessible for most traders.

Premium Account: The Premium Account is designed for more active traders who require lower spreads and additional features such as advanced trading tools and dedicated customer support. This account typically requires a higher minimum deposit.

Professional Account: Professional traders can benefit from the Professional Account, which offers even lower spreads, higher leverage options, and priority customer service. This account is ideal for traders with significant trading experience and larger capital.

Robo-Advisory Account: For those interested in automated investing, the Robo-Advisory Account provides a hassle-free way to invest in a diversified portfolio managed by Swissquote’s algorithms. This account is perfect for long-term investors who prefer a more passive investment approach.

Corporate Account: Businesses and institutional clients can open a Corporate Account, which offers tailored solutions to meet the needs of corporate trading and investment strategies. This account includes customized trading conditions, premium support, and advanced reporting tools.

Deposits and Withdrawals

- Bank Transfers: This is the most common method, allowing clients to transfer funds directly from their bank accounts. Swissquote supports both local and international bank transfers, making it accessible for clients in the MENA region.

- Credit/Debit Cards: For faster transactions, clients can use Visa, MasterCard, and Maestro cards. This method is particularly convenient for those who want to start trading immediately.

- E-Wallets: Swissquote also supports popular e-wallets like Skrill and Neteller, offering another fast and secure option for depositing funds.

- Bank Transfers: Withdrawals are typically processed through bank transfers. The process is straightforward, although international transfers may take a few days to complete.

- Credit/Debit Cards: Withdrawals to credit or debit cards are also supported but are less commonly used compared to bank transfers.

- E-Wallets: Clients can withdraw funds to their e-wallet accounts, with transactions usually being processed within 24 hours.

Fees and Costs

- Spreads: Swissquote operates on a spread-based pricing model. The spreads are competitive, starting from 0.6 pips for major currency pairs. However, spreads can vary based on market conditions and the type of account held by the trader.

- Commissions: For some instruments like CFDs and Forex, Swissquote charges a commission in addition to the spread. This commission varies depending on the volume of the trade and the specific instrument.

- Inactivity Fee: Swissquote charges an inactivity fee for accounts that have been dormant for a certain period. This fee can be avoided by making regular trades or transactions.

- Withdrawal Fees: As mentioned earlier, withdrawal fees may apply, especially for international bank transfers. The fees are generally reasonable but vary depending on the withdrawal method and currency.

- Account Maintenance Fees: Swissquote does not charge any account maintenance fees, which is a significant advantage for long-term traders.

Education and Resources

- Webinars and Seminars: Swissquote regularly hosts webinars and seminars covering a wide range of topics, from basic trading strategies to advanced market analysis. These sessions are conducted by industry experts and are invaluable for continuous learning.

- Tutorials and Guides: The broker offers a comprehensive collection of tutorials and guides that cover various aspects of trading. These resources are designed to help traders understand the platform and develop effective trading strategies.

- Market Analysis: Swissquote provides daily market analysis, including technical and fundamental analysis, to help traders make informed decisions. The analysis is available on their website and via email newsletters.

- Demo Accounts: Swissquote offers demo accounts that allow traders to practice their strategies without risking real money. This is a great way for beginners to get comfortable with the platform.

- Trading Academy: Swissquote’s Trading Academy is an extensive educational portal that includes articles, videos, and interactive courses on trading and investment. The academy is designed to cater to traders of all skill levels.

- Research Tools: The platform is equipped with a variety of research tools, including economic calendars, market news, and real-time data feeds. These tools are essential for making well-informed trading decisions.

Customer Support

- Availability: Swissquote offers 24/5 customer support, aligning with the global trading hours. This ensures that clients can get help when they need it, regardless of their time zone.

- Channels: Support is accessible through various channels, including phone, email, and live chat. The live chat feature is particularly commendable for its quick response time and ease of use.

- Quality: The support team is knowledgeable and professional, capable of addressing a wide range of queries from technical issues to account management. Clients have reported high satisfaction with the quality of service, emphasizing the team’s ability to resolve issues efficiently.

Security

- Regulation: Swissquote is regulated by top-tier financial authorities, including the Swiss Financial Market Supervisory Authority (FINMA) and the UK’s Financial Conduct Authority (FCA). These regulations ensure that Swissquote adheres to stringent security and operational standards.

- Data Protection: Advanced encryption technologies safeguard all transactions and personal data. Swissquote’s platform employs Secure Socket Layer (SSL) encryption to protect information from unauthorized access.

- Account Protection: Swissquote offers negative balance protection and segregates client funds from the company’s operational funds, providing an additional layer of security. In the event of the broker’s insolvency, client funds remain safe and accessible.

User Reviews and Community Trust

Pros and Cons

- Diverse Trading Instruments: Swissquote offers a wide array of trading instruments, including stocks, forex, commodities, and cryptocurrencies. This variety caters to both conservative investors and those seeking high-risk, high-reward opportunities.

- Advanced Trading Platforms: Swissquote’s platforms, including its proprietary Advanced Trader and the popular MetaTrader 4 and 5, are user-friendly and equipped with sophisticated trading tools and analytics.

- Educational Resources: The broker provides extensive educational materials, including webinars, tutorials, and market analysis. These resources are invaluable for both novice traders and seasoned investors looking to sharpen their skills.

- Strong Regulatory Oversight: Being regulated by multiple top-tier authorities ensures that Swissquote operates with a high level of integrity and accountability.

- Excellent Customer Support: The multilingual support team is highly responsive and effective in resolving client issues, enhancing the overall trading experience.

- Higher Fees: Compared to some other brokers in the MENA region, Swissquote’s fee structure can be on the higher side. This includes higher commissions and spreads, which may deter cost-sensitive traders.

- Limited Payment Methods: The available payment methods for deposits and withdrawals are somewhat limited, which can be inconvenient for some users.

- Complex Platform for Beginners: While advanced traders may find Swissquote’s platforms rich with features, beginners might find them complex and overwhelming initially.

Conclusion

Swissquote stands out as a reliable and comprehensive trading platform suitable for traders in the MENA region. Its wide range of assets, advanced trading platforms, and strong regulatory compliance make it an attractive choice for both novice and experienced traders. While the high minimum deposit and complex fee structure may be drawbacks for some, the overall benefits and robust features of Swissquote make it a noteworthy option in the trading landscape.

For traders looking for a secure, versatile, and well-regulated broker, Swissquote offers a compelling proposition. By leveraging its extensive resources and user-friendly platforms, traders can navigate the financial markets with confidence and ease.

FAQ

Swissquote is a leading online brokerage firm that offers a wide range of trading instruments, including stocks, forex, commodities, and cryptocurrencies. The broker is known for its robust trading platforms, regulatory compliance, and comprehensive customer support.

Yes, Swissquote is regulated by top-tier financial authorities, including the Swiss Financial Market Supervisory Authority (FINMA) and the UK’s Financial Conduct Authority (FCA). These regulations ensure that the broker operates under strict security and operational standards.

Swissquote provides several advanced trading platforms, including its proprietary Advanced Trader platform and the widely used MetaTrader 4 and MetaTrader 5. These platforms are equipped with sophisticated trading tools and analytics to cater to different trading needs.

Swissquote offers a variety of account types to meet different trading needs, including standard accounts, premium accounts, and professional accounts. Each account type comes with its own set of features and benefits tailored to different levels of trading experience and investment goals.

Opening an account with Swissquote is straightforward. You can start by visiting their website, selecting the type of account you wish to open, and completing the online registration form. You will need to provide some personal information and submit verification documents.

The minimum deposit requirement at Swissquote varies depending on the type of account you choose. For most standard accounts, the minimum deposit starts at around $1,000.

Swissquote’s fee structure includes commissions, spreads, and other charges. While the fees can be higher compared to some other brokers, they are transparent with no hidden charges. It’s important to review the fee schedule on their website to understand the costs involved.