- Founded: 2002

- Headquarters: Belize

- Min deposit: 1 USD

- Max Leverage: 1 : 500

- In the dynamic world of online trading, choosing the right broker can significantly impact your trading success. XTB stands out as one of the leading brokerage firms in the MENA region, renowned for its robust trading platform, extensive range of assets, and exceptional customer service. This review provides an in-depth analysis of XTB, exploring its features, services, and overall performance to help you determine if it’s the right choice for your trading needs.

Company Overview

Founded in 2002, XTB has established itself as a major player in the global financial markets with a strong presence in the MENA region. It’s regulated by several top-tier authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC), ensuring a high level of trust and security for traders.

Trading Platforms

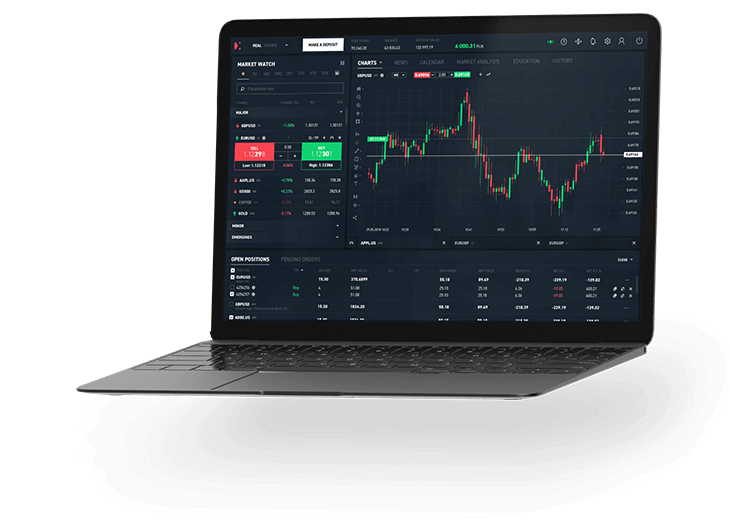

XTB offers a choice between two highly sophisticated trading platforms: xStation 5 and MetaTrader 4 (MT4). Each platform caters to different types of traders, making XTB a versatile choice for novices and experienced traders alike.

- xStation 5: XTB’s flagship platform, xStation 5, is renowned for its user-friendly interface and impressive execution speeds. It is web-based, meaning traders can access it from any computer without the need for downloads or installations. xStation 5 is designed with the end-user in mind, featuring customizable charts, live performance statistics, and a comprehensive trader’s calculator. One of the standout features is the ‘Market Sentiment’ tool, which shows the percentage of clients buying and selling a specific asset, providing insights into market trends.

- MetaTrader 4: For those who prefer a more established trading environment, XTB also offers MT4. This platform is particularly favored by advanced traders for its automated trading capabilities through Expert Advisors (EAs). MT4 with XTB allows for micro lot trading and provides access to a wide range of technical indicators and charting tools. It’s an excellent choice for those looking to implement complex trading strategies.

Tradable Assets

XTB offers an extensive range of tradable assets, ensuring that traders of all preferences and strategies can find suitable instruments. Here’s a breakdown of the asset classes available:

Forex: XTB provides a competitive forex trading environment with over 50 currency pairs, including major, minor, and exotic pairs. The spreads are notably tight, starting from just 0.1 pips for major currency pairs, which is highly competitive in the region.

Commodities: Traders can also engage in commodity trading, with a selection that includes oil, gold, silver, and other metals. Commodities are a popular choice for those looking to diversify their trading strategies beyond forex.

Indices and Stocks: XTB offers trading on a wide variety of global indices and stocks. This includes not only major US stocks and indices but also local MENA region markets, which is a significant advantage for regional traders looking to trade in familiar markets.

Cryptocurrencies: Recognizing the growing demand for cryptocurrency trading, XTB has included a selection of the most popular cryptocurrencies, including Bitcoin, Ethereum, and Ripple, which can be traded against the USD.

Account Types

XTB simplifies its offering with two main types of accounts: Standard and Pro. Both account types cater to different trader needs and investment scales:

Standard Account: The Standard account is ideal for novice traders or those who prefer straightforward trading. It offers commission-free trading with spreads only. This account type provides access to all platforms and all of the tradable assets offered by XTB. The minimum deposit requirement is relatively low, making it accessible for beginners.

Pro Account: Designed for more experienced traders who handle larger volumes, the Pro account offers even tighter spreads and charges a commission per lot traded. This account is particularly attractive for high-volume traders looking to minimize their trading costs.

Both accounts come with negative balance protection, free educational resources, and dedicated customer support. XTB also provides Islamic accounts compliant with Sharia law, which is crucial for Muslim traders in the MENA region.

Deposits and Withdrawals

Fees and Costs

Education and Resources

Customer Support

Security

User Reviews and Community Trust

Pros and Cons

- Regulated by Top-Tier Authorities: XTB’s compliance with multiple regulatory standards underscores its reliability and commitment to trader security.

- Comprehensive Educational Resources: The broker provides an extensive range of learning materials, which are regularly updated to reflect market changes and new trading technologies.

- Advanced Trading Platform: XTB offers a sophisticated trading platform equipped with all the tools necessary for detailed market analysis and trading.

- Excellent Customer Support: With multilingual support and multiple communication channels, XTB places a high priority on customer service.

- Withdrawal Fees and Times: Some users have reported longer than expected wait times for withdrawals, as well as higher fees compared to other brokers.

- Limited Product Portfolio in Some Countries: Depending on the region, the range of products available can be limited, which might restrict trading strategies.

Conclusion

XTB is an excellent choice for traders looking for a reliable, well-regulated broker in the MENA region. Its user-friendly platform, extensive range of tradable assets, and commitment to education and customer support make it suitable for traders of all levels. While there are some fees to be mindful of, such as the inactivity fee, the overall cost structure is competitive. Whether you’re beginning your trading journey or looking to switch to a broker that aligns better with your trading strategies, XTB is certainly worth considering.

FAQ

XTB offers several types of trading accounts to suit different trading strategies and experience levels. These include a basic account for beginners, a standard account for regular traders, and a pro account for more experienced traders with lower spreads but higher commission on trades. Additionally, XTB provides an Islamic account option that complies with Sharia law.

Yes, XTB is regulated by several top-tier financial authorities worldwide, including the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the UK, and other regulatory bodies relevant to its operations in the MENA region. This regulatory framework ensures that XTB adheres to strict financial standards and practices.

XTB offers its custom trading platform, xStation 5, which is known for its user-friendly interface, speedy execution, and innovative trading tools. xStation 5 is available on desktop, web browsers, and mobile devices, allowing traders to manage their portfolios from anywhere at any time.

Yes, XTB provides the opportunity to trade in cryptocurrencies alongside other financial instruments like forex, commodities, indices, and stocks. However, the availability of cryptocurrencies and other products can vary by region due to local regulations.

XTB charges different fees depending on the account type and the instruments traded. While forex trading on the basic and standard accounts might include wider spreads with no commission fees, the pro account typically offers tighter spreads but includes a commission fee. Additionally, there might be fees for withdrawals and inactivity. It is advisable to review the full fee structure on the XTB website or contact their customer service for detailed information.

Funds can be deposited into an XTB account via several methods, including bank transfer, credit/debit cards, and e-wallets like PayPal and Skrill. The broker ensures that all transactions are secured using advanced encryption technologies. It’s important to check if any fees apply to your chosen deposit method.

XTB is committed to providing exceptional customer support. Traders can contact the support team 24/5 via telephone, email, and live chat. Support is available in multiple languages to cater to the diverse clientele in the MENA region. XTB also offers a rich library of educational resources and trading tools to assist traders in their investment journey.