- Founded: 2005

- Headquarters: USA

- Min deposit: 50 USD

- Max Leverage: 1 : 500

In the dynamic world of online trading, choosing the right broker is crucial for ensuring a successful trading journey. For traders in the MENA region, MultiBank Group stands out as a prominent option, boasting a comprehensive suite of trading tools, robust regulatory framework, and competitive trading conditions. This review will explore all aspects of MultiBank Group, from its platform offerings and fees to customer support and regulatory compliance.

Company Overview

Founded in 2005, MultiBank Group has established itself as one of the largest online financial derivatives providers worldwide, offering services in forex, metals, shares, indices, and commodities. The broker prides itself on combining technological prowess with a vast range of financial products, giving traders of all levels the tools they need to execute their trading strategies effectively.

Trading Platforms

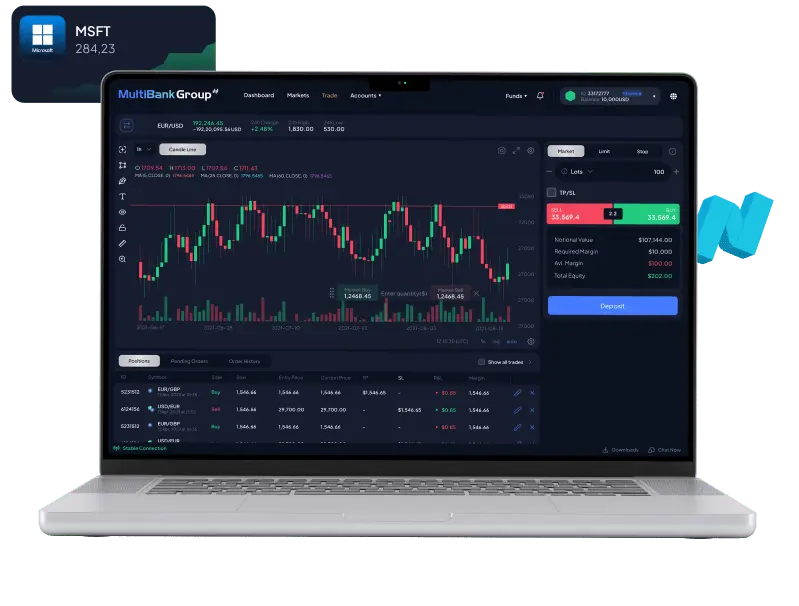

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5): MultiBank Group offers both the MT4 and MT5 platforms, which are among the most respected trading platforms in the industry. MT4 is famed for its user-friendly interface, advanced charting tools, and robust technical analysis capabilities. It caters primarily to forex traders but is also capable of handling CFDs and futures trading. MT5, being the successor to MT4, offers all the beloved features of its predecessor but with added capabilities such as more timeframes, built-in economic calendars, and enhanced order management tools. Both platforms are available for desktop, web, and mobile applications, ensuring traders can access their accounts and trade from anywhere at any time.

- MultiBank Pro Platform: In addition to the MetaTrader offerings, MultiBank Group has developed its proprietary platform, the MultiBank Pro Platform. This platform is designed to cater to the needs of professional traders, offering more sophisticated trading tools and comprehensive market analysis features. The Pro Platform stands out for its high-speed execution, real-time market updates, and customizable interface, which can be tailored to the individual preferences of traders.

Tradable Assets

MultiBank Group provides a diverse range of tradable assets, making it a versatile choice for investors looking to expand their trading portfolios:

Forex: Traders can access over 45 currency pairs, including major, minor, and exotic pairs, all with competitive spreads and leverage up to 500:1.

Stocks and Indices: A significant selection of shares from major companies and indices from global markets are available for trading. Investors can engage with both US and international markets, enjoying direct market access and real-time price feeds.

Commodities: MultiBank Group offers trading in a variety of commodities such as gold, silver, oil, and gas. These can be traded as spot contracts or derivatives, providing traders with flexibility in their investment strategies.

Cryptocurrencies: In response to the growing demand for digital currencies, MultiBank Group has included a range of cryptocurrencies for trading, such as Bitcoin, Ethereum, and Litecoin, among others.

Account Types

MultiBank Group caters to a diverse clientele by offering several account types that suit different trading styles and investment goals:

- ECN Pro: The ECN Pro account is designed for advanced traders who require tight spreads and faster execution. This account features spreads from as low as 0.0 pips and a commission of $3 per lot.

- MultiBank Pro: For traders who prefer to trade with higher leverage and access to a broader range of instruments, the MultiBank Pro account provides leverage up to 500:1 with spreads starting from 0.1 pips.

- Maximus: The Maximus account is tailored for entry-level traders who are new to the forex market. It offers zero commissions and spreads starting from 1.4 pips, making it an excellent choice for those just starting their trading journey.

- Islamic Account: MultiBank Group respects the needs of Muslim traders by offering Sharia-compliant Islamic accounts that adhere to Islamic finance principles. These accounts do not incur swap or interest charges on overnight positions.

Each account type also comes with access to 24/5 customer support, daily account statements, and a personal account manager to assist traders in maximizing their trading potential.

Deposits and Withdrawals

Fees and Costs

Education and Resources

Customer Support

Security

User Reviews and Community Trust

Pros and Cons

- Extensive Regulation: MultiBank Group is regulated by multiple top-tier authorities, offering traders a high level of security and trust.

- Robust Customer Support: Available 24/5 with multilingual options, providing accessible and efficient help across various platforms.

- Advanced Trading Platforms: Offers a choice between MetaTrader 4 and MetaTrader 5, which are among the most popular platforms due to their user-friendliness and powerful features.

- Competitive Spreads and Fees: The broker offers some of the best spreads in the market, enhancing profitability for traders.

- Educational Resources: Provides an excellent range of educational materials, including webinars, tutorials, and articles that cater to both beginners and experienced traders.

- Withdrawal Fees: Some users have reported that the withdrawal fees can be somewhat high, which might be a consideration for traders who operate with smaller volumes.

- Account Verification Process: A few users have mentioned delays in the account verification process, which can be a setback for new users eager to start trading immediately.

Conclusion

MultiBank Group is a robust choice for traders in the MENA region, offering a mix of powerful trading platforms, diverse financial products, and stringent regulatory oversight. Whether you are a novice trader or a seasoned professional, MultiBank Group provides the tools and conditions needed to support effective trading strategies.

Its commitment to transparency, competitive fees, and comprehensive educational resources make it a standout option, catering to a broad spectrum of trading needs and preferences. As always, traders should perform their due diligence and consider their financial goals and trading style before committing to a broker.

FAQ

Yes, MultiBank Group is regulated by several top-tier regulatory bodies, including the Australian Securities and Investments Commission (ASIC), the Federal Financial Supervisory Authority (BaFin) of Germany, and other global authorities. This ensures that the broker operates under strict guidelines and maintains high standards of financial integrity and customer protection.

MultiBank Group offers various account types to suit different trading styles and investment levels, including standard accounts for beginners, professional accounts for experienced traders, and Islamic accounts that comply with Sharia law. Each account type has different features and benefits, tailored to meet the specific needs of different traders.

MultiBank Group supports a variety of funding methods, including bank wire transfers, credit/debit cards, and several e-wallets like Skrill and Neteller. The availability of these methods may vary depending on the trader’s country of residence.

Yes, MultiBank Group may charge withdrawal fees depending on the method used and the currency involved. It is advisable to check the specific fees on MultiBank Group’s website or contact their customer service for detailed information regarding withdrawal charges.

MultiBank Group offers trading on the MetaTrader 4 and MetaTrader 5 platforms, which are among the most popular and powerful trading platforms in the industry. These platforms are available on desktop, web, and mobile versions, allowing traders to manage their accounts and trade from anywhere at any time.

MultiBank Group uses advanced security protocols to protect client data and funds. This includes SSL encryption for all data transmission, segregated accounts to keep clients’ funds separate from the company’s operational funds, and strict adherence to regulatory requirements that enhance financial security and transparency.

Yes, MultiBank Group offers cryptocurrency trading among its services. Traders can trade popular cryptocurrencies as CFDs, allowing them to speculate on the price movements of these digital assets without needing to own them directly.