- Founded: 2009

- Headquarters: Cyprus

- Min deposit: 5 USD

- Max Leverage: 1 : 888

XM is a well-known global brokerage firm that has been extending its services to traders within the Middle East and North Africa (MENA) region. Known for its robust trading platforms, wide range of financial instruments, and strong regulatory framework, XM aims to provide a superior trading experience. This review explores the various aspects of XM’s services, assessing its suitability for traders and investors in the MENA region.

Company Overview

Founded in 2009, XM has grown to serve over 3.5 million clients from 196 countries. The broker is well-regarded for its transparent and client-centered services. XM Group is licensed by several regulatory authorities, including the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the International Financial Services Commission of Belize (IFSC).

Trading Platforms

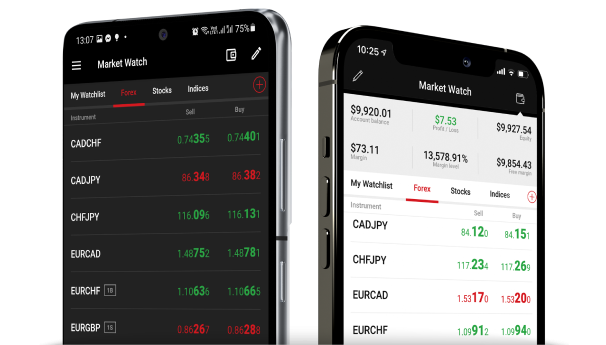

MetaTrader 4 (MT4)

XM offers the highly popular MetaTrader 4 platform, which is well-suited for both new and experienced traders. MT4 is renowned for its user-friendly interface, advanced charting tools, and automated trading capabilities via Expert Advisors (EAs). The platform provides a seamless trading experience with customizable charts, a wide range of technical indicators, and support for multiple order types. MT4’s robustness and reliability make it an excellent choice for algorithmic trading.

MetaTrader 5 (MT5)

In addition to MT4, XM also provides access to MetaTrader 5, which builds upon the strengths of its predecessor with enhanced trading features. MT5 offers more technical indicators, graphical objects, and timeframes, along with an economic calendar integrated directly into the platform. It supports trading stocks, forex, and futures, making it a versatile option for traders looking to expand their investment portfolios. The platform also enhances the trading experience with a more powerful strategy tester for EAs and better scripting tools for custom indicator development.

XM WebTrader

For those who prefer not to download software, XM’s WebTrader offers a convenient and accessible alternative. Fully compatible with both MT4 and MT5 accounts, WebTrader allows users to access global markets directly from their web browsers without compromising on features or performance. The platform’s interface is clean and intuitive, providing all the essential tools and resources needed for effective market analysis and trading.

Tradable Assets

XM stands out in the diversity of its asset offerings. Catering to clients in the MENA region, it provides access to a wide range of markets:

Forex Trading: forex traders at XM can access over 55 currency pairs, including all the major pairs, as well as several minor and exotic pairs. Spreads are competitive, starting from as low as 0.6 pips, and traders can leverage up to 888:1, depending on the account type and client eligibility.

Commodities: traders can also diversify their portfolios with a selection of commodities. XM allows trading in various commodities such as gold, silver, oil, and agricultural products (e.g., coffee and sugar), available through CFDs, which provide the flexibility to profit from both rising and falling markets.

Indices and Stocks: those interested in equity markets can trade indices and stocks from large markets such as the USA, UK, and Asia. XM offers CFDs on many major indices like the S&P 500, FTSE 100, and Nikkei 225. Moreover, stock CFDs are available, allowing traders to speculate on the price movements of major companies without needing to own the underlying assets.

Cryptocurrencies: responding to the growing demand for digital assets, XM has introduced cryptocurrency trading. Clients can trade CFDs on major cryptocurrencies such as Bitcoin, Ethereum, and Litecoin, offering a way to engage with this dynamic asset class.

Account Types

XM accommodates various trader needs with four different account types:

- Micro Account: ideal for beginners or those testing new strategies, the Micro Account allows trading with micro lots (1,000 units of the base currency). The minimum deposit is only $5, making it accessible for low-volume traders.

- Standard Account: the Standard Account is suited for experienced traders and offers more substantial volumes with standard lots (100,000 units). Like the Micro Account, it requires a minimum deposit of just $5.

- XM Zero Account: this account type appeals to high-volume traders who seek even tighter spreads. XM Zero Accounts feature spreads as low as 0 pips, although there is a commission per trade. The minimum deposit for this account is higher, set at $100.

- Islamic Account: adhering to the Sharia law, XM offers an Islamic Account option for all the above account types, which does not incur swap or rollover charges on overnight positions, making it ideal for Muslim traders who require swap-free accounts.

Deposits and Withdrawals

Fees and Costs

Education and Resources

Customer Support

Security

User Reviews and Community Trust

Pros and cons

- Comprehensive Educational Resources: XM offers an extensive range of learning tools, including webinars, seminars, e-books, and educational videos, which are tailored to different skill levels.

- Strong Regulatory Framework: Being regulated by multiple authorities helps ensure that XM operates to high standards of fairness and integrity.

- Multilingual Customer Support: The availability of support in multiple languages makes XM accessible to traders in various parts of the MENA region.

- Wide Range of Trading Instruments: Clients can trade a diverse array of instruments, including forex, stocks, commodities, and indices.

- Platform Performance: Some users report occasional lag during peak trading times.

- Withdrawal Delays: While not a frequent issue, some users have experienced slower than advertised withdrawal times.

- Inactivity Fees: XM charges a monthly inactivity fee which might discourage less active traders.

Conclusion

XM is a robust option for MENA traders looking for a reliable and versatile online broker. Its adherence to regulatory standards, combined with comprehensive trading platforms, a wide range of instruments, and competitive fees, makes it a suitable choice for traders and investors of all levels. Whether you’re looking to trade forex, stocks, or other commodities, XM provides a secure and supportive trading environment.

XM’s commitment to technology, customer service, and trader education makes it a standout choice in the crowded field of online brokers. If you’re a trader in the MENA region considering XM, their platform is well worth a closer look to see

FAQ

Yes, XM is regulated by several regulatory bodies, including the International Financial Services Commission (IFSC) in Belize and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. This ensures that XM adheres to strict standards of operation and client protection.

XM offers several account types to cater to different trading preferences and levels of experience, including Micro, Standard, and XM Zero accounts. Each type has distinct features, such as different leverage options, spreads, and minimum deposit requirements.

As of the last update, XM does not offer cryptocurrency trading. XM provides a wide range of trading instruments, including forex, commodities, equity indices, precious metals, and energies.

Yes, XM offers Islamic accounts that comply with Sharia law. These accounts do not incur swap or rollover charges on overnight positions, making them suitable for Muslim traders who must comply with these financial regulations.

XM supports several trading platforms, including the highly popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are available on desktop, web, and mobile versions, providing traders with flexible and accessible trading options.

XM does not charge commissions on most trades. However, fees may be associated with certain types of accounts or services, such as XM Zero accounts, which offer lower spreads but include a commission on trades. Additionally, traders should be aware of potential inactivity fees if they do not trade for an extended period.

XM provides customer support 24/5, aligning with the global forex market hours. Support is available via live chat, email, and telephone. Importantly, XM offers multilingual support, including support in Arabic, which is a significant advantage for traders in the MENA region.