- Founded: 1999

- Headquarters: USA

- Min deposit: 100 USD

- Max Leverage: 1 : 200

Forex.com stands out as one of the leading platforms in the global forex market, catering extensively to traders in the MENA region. This detailed review aims to provide an exhaustive overview of Forex.com, evaluating its services, platform features, regulatory compliance, customer support, and much more. Our goal is to furnish traders with the crucial information needed to make informed decisions about using Forex.com for their trading needs.

Introduction to Forex.com

Forex.com has established itself as a formidable name in the world of online trading, primarily focusing on forex and CFDs. The broker prides itself on offering robust trading solutions that cater to both novice and experienced traders. With a user-friendly interface, comprehensive market research, and a commitment to regulatory compliance, Forex.com strives to provide a reliable and efficient trading environment.

Trading Platforms

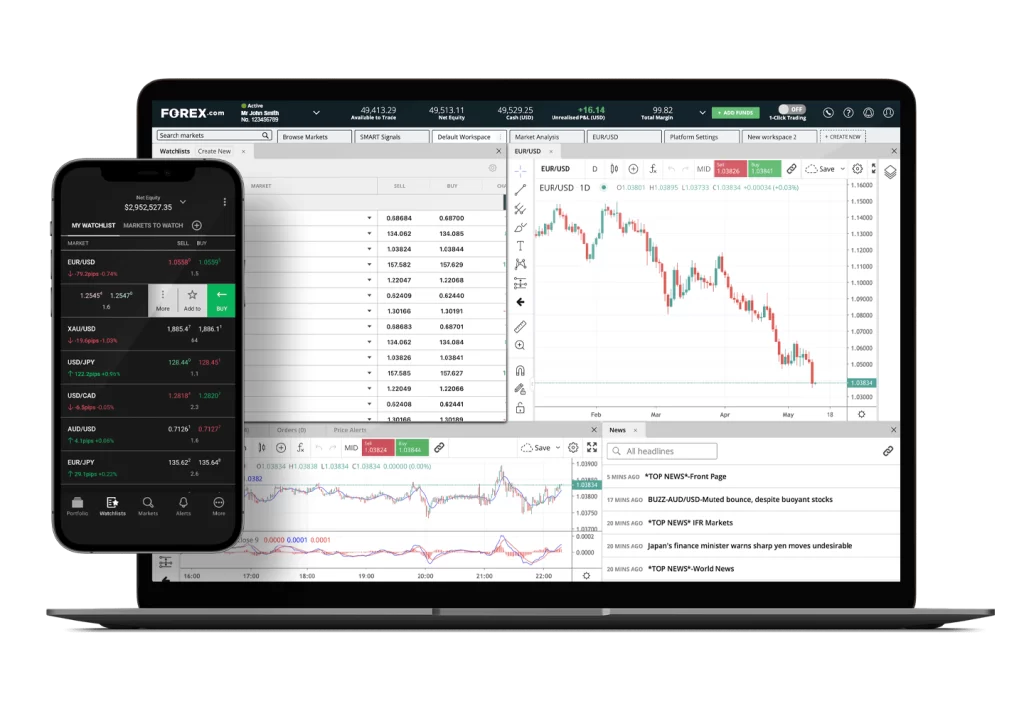

Forex.com offers a variety of trading platforms, catering to the needs of both novice and experienced traders. Each platform is designed to provide a seamless and efficient trading experience, ensuring that users can manage their trades quickly and effectively.

-

- Forex.com Platform: This is the broker’s proprietary platform, offering powerful trading tools and advanced charting capabilities. It is web-based, which means traders can access it from any internet-enabled computer without downloading any software. The platform features a user-friendly interface that makes it easy for beginners to navigate while still providing advanced features that seasoned traders expect.

- MetaTrader 4 (MT4): Recognized globally for its reliability and array of tools, MT4 is available to Forex.com’s clients. It supports a vast range of analytical tools, over 50 indicators, and customizable charts. For traders interested in automated trading, MT4’s Expert Advisors (EAs) provide a significant advantage, allowing for algorithmic trading strategies to be executed automatically.

- MetaTrader 5 (MT5): As the successor to MT4, MT5 offers all the esteemed features of its predecessor along with additional capabilities such as more timeframes, technical indicators, and graphical objects. This platform also supports an improved scripting tool for writing custom indicators and automated trading systems.

Mobile Trading: Forex.com has also optimized mobile trading solutions for traders who prefer to manage their investments on the go. The mobile apps provide robust functionality, mirroring the desktop experience with full order functionality, advanced charting, and support for multiple technical indicators.

Tradable Assets

Forex.com offers a comprehensive range of tradable assets, making it a versatile choice for traders looking to diversify their portfolios.

-

- Forex: As the name suggests, Forex.com specializes in currency trading with a wide selection of currency pairs, including all major pairs and a variety of minor and exotic pairs. This wide selection allows traders to capitalize on global economic events and forex market volatility.

- Commodities: Traders can also trade a range of commodities, which include precious metals like gold and silver, energy commodities such as oil and natural gas, and soft commodities like coffee and sugar. Commodities trading is popular among traders looking to hedge other investments or capitalize on changes in supply and demand.

- Indices and Stocks: Forex.com provides opportunities to trade on global indices and stocks, which is ideal for those interested in equity markets. This allows traders to take positions on global economic performance and individual company performances.

- Cryptocurrencies: Given the rising popularity of digital currencies, Forex.com has included a selection of the most popular cryptocurrencies for trading, such as Bitcoin, Ethereum, and Litecoin.

Account Types

Forex.com understands that different traders have different needs and preferences. As such, it offers several account types to cater to the diverse requirements of its clientele.

- Standard Account: This account is suitable for most traders, featuring standard access to all trading platforms, a robust set of analytical tools, and competitive spreads.

- Commission Account: Best suited for high-volume traders, this account offers lower spreads in exchange for a fixed commission per trade. It is popular among experienced traders looking for cost-efficient trading on price movements.

- Direct Market Access Account: Aimed at high-end professional traders, this account type provides direct access to the market, offering higher visibility and execution speed. It’s an excellent choice for scalpers and traders using high-frequency trading strategies.

- Demo Account: For beginners or those looking to explore Forex.com’s offerings without financial risk, the demo account provides a risk-free environment with virtual currency. It is an excellent way to familiarize oneself with the platform, test strategies, and understand market dynamics without real-world implications.

Deposits and Withdrawals

Forex.com offers a streamlined deposit and withdrawal process that caters to the needs of MENA region traders. Clients can fund their accounts using multiple methods including credit and debit cards, bank wire transfers, and e-wallets such as PayPal and Skrill. Importantly for local traders, Forex.com also supports several payment methods that are popular in the MENA region, ensuring that traders can fund their accounts conveniently.

Deposit Times and Fees: Credit card and e-wallet deposits are usually processed instantly, while bank wires may take between 1 to 2 business days. Forex.com does not charge any fees for deposits. However, it’s essential to note that third-party fees may apply, and traders should consult their bank or payment provider for detailed information.

Withdrawal Speed and Policy: Withdrawals at Forex.com are processed quickly, generally within 24 to 48 hours after the request. However, the time it takes for the funds to appear in your account will depend on the withdrawal method used. Forex.com prioritizes security in their withdrawal process, requiring clients to use the same withdrawal method as their deposit to prevent any fraud. This security measure is crucial for traders in the MENA region looking for reliable financial transactions.

Fees and Costs

Forex.com operates on a low-fee model that makes it an attractive option for traders concerned about high costs eating into their profits. Here’s a breakdown of the main fees:

Spreads: The broker offers competitive spreads starting from as low as 0.2 pips for major currency pairs such as EUR/USD. Spreads may vary based on market conditions and the type of account.

Commission: Forex.com offers commission-free trading on most currency pairs. However, for shares and other select instruments, a commission may be charged. The exact structure depends on the specific asset being traded and the market.

Overnight Fees: Traders holding positions overnight should be aware of the swap/rollover fees, which are competitive but vary depending on the currency pair and market conditions.

No Hidden Fees: Forex.com maintains transparency in its fee structure. There are no hidden fees for account maintenance or inactivity, which is particularly beneficial for traders who do not trade frequently.

Education and Resources

Forex.com distinguishes itself with an exceptional range of educational resources and trading tools designed to support traders of all experience levels. Their comprehensive educational suite is particularly beneficial for traders in the MENA region, as it provides insights not only into global markets but also into local trading conditions.

Educational Materials: Forex.com offers a wealth of learning materials, including webinars, e-books, articles, and video tutorials covering a wide range of topics from the basics of forex trading to advanced technical analysis strategies. These resources are available in multiple languages, making them accessible to traders in the MENA region.

Research Tools and Insights: Traders have access to advanced charting tools, real-time news, market analysis, and trading signals. These resources are integrated into the trading platform, allowing traders to make informed decisions based on the latest market trends and analysis.

Demo Account: One of the standout features is the availability of a free demo account. This allows MENA region traders to practice their trading strategies in a risk-free environment, using virtual funds to simulate real trading conditions.

Customer Support

Forex.com offers a solid customer support system that is tailored to meet the needs of traders from different parts of the world, including those in the MENA region. Customers can reach out to the support team via multiple channels:

-

- Live Chat: Available directly on the website, this feature provides instant access to support staff. It’s particularly useful for urgent inquiries and troubleshooting.

-

- Email Support: For more detailed queries that require thorough responses, email support is available. Forex.com typically responds within one business day.

-

- Phone Support: Forex.com provides a dedicated phone line with multilingual support, accommodating the diverse linguistic needs of the MENA region.

-

- Educational Resources: Apart from direct support, Forex.com offers a wealth of educational materials, including webinars, e-books, and video tutorials, which are invaluable for traders looking to expand their knowledge.

Security

In terms of security, Forex.com demonstrates a high standard of measures to protect its clients’ investments and personal information:

-

- Regulation: Forex.com is regulated by several top-tier financial authorities globally, which ensures that it adheres to the strictest standards of financial security and operational integrity.

-

- Data Encryption: The platform uses advanced encryption technologies to secure user data and financial transactions.

-

- Two-Factor Authentication (2FA): This optional feature adds an extra layer of security, protecting accounts from unauthorized access.

-

- Segregated Accounts: Clients’ funds are kept in segregated bank accounts, ensuring that personal funds are never mixed with the company’s operating funds.

User Reviews and Community Trust

User reviews on various independent websites generally paint a positive picture of Forex.com, highlighting the broker’s reliable platform and comprehensive educational resources. However, some users have pointed out areas for improvement such as the customization options of the trading platform and the responsiveness of customer support during peak times.

In the MENA region, Forex.com enjoys a solid reputation, largely due to its adherence to international regulatory standards and its robust security measures. This trust is further bolstered by the broker’s active engagement in local trading communities through seminars and training sessions, helping to foster a strong relationship with regional traders.

Pros and Cons

- Wide Range of Markets: Forex.com offers an extensive array of trading instruments, including forex, commodities, indices, and stocks CFDs, making it a suitable platform for traders looking to diversify their portfolios.

- Advanced Trading Platforms: Traders can access sophisticated trading tools and platforms such as the popular MetaTrader 4, the advanced MetaTrader 5, and Forex.com’s own proprietary platform, all of which come with comprehensive analytical tools, charts, and automated trading capabilities.

- Competitive Spreads: Forex.com offers competitive spreads, especially on major currency pairs, which can significantly lower the cost of trading for frequent traders.

- Platform Complexity: New traders might find the range of tools and platforms a bit overwhelming. While the educational resources are helpful, the learning curve can be steep.

- Customer Service Response Times: During periods of high demand, the response times for customer service can be slow, which some users may find frustrating.

- Limited Account Currencies: While Forex.com supports major currencies for account funding, options are somewhat limited compared to other global brokers, which might incur conversion fees for some MENA traders.

CONCLUSION

Forex.com is a robust option for traders in the MENA region, providing a secure, regulated, and feature-rich trading environment. With its diverse range of account types, platforms, and tradable assets, it caters to the needs of a broad spectrum of traders. Its commitment to education, customer support, and regulatory compliance further solidifies its position as a top choice for regional traders.

In conclusion, whether you are starting your trading journey or looking to advance your trading strategies, Forex.com offers a comprehensive and reliable platform that can support your trading ambitions in the MENA region.

FAQ

Yes, Forex.com is a globally regulated broker, ensuring compliance with international financial standards. While specific regulatory details can vary by country within the MENA region, Forex.com generally adheres to the stringent regulations set by top-tier financial authorities around the world to offer secure and reliable trading services.

Forex.com provides several trading platforms to cater to various trading preferences and strategies. These include:

- MetaTrader 4 (MT4): Widely recognized for its powerful charting tools and automated trading capabilities.

- MetaTrader 5 (MT5): An advanced platform offering additional features and greater flexibility than MT4, suitable for both forex and stock trading.

- Forex.com’s Proprietary Platform: Offers advanced charting, a customizable dashboard, and integrated trading tools designed for both new and experienced traders.

Forex.com allows trading in major cryptocurrencies through CFDs (Contracts for Difference), providing an opportunity to trade crypto without owning the underlying asset. This includes popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. It’s important to note that cryptocurrency trading is not available in all regions due to regulatory constraints.

Forex.com supports a variety of payment methods for deposits and withdrawals, including:

- Credit and Debit Cards

- Bank Wire Transfers

- E-Wallets such as Skrill and Neteller

Payment methods can vary by country, so it’s advisable to check the availability of specific options in your region on the Forex.com website.

Forex.com does not charge commissions on most trades; instead, the broker earns money through spreads. Spreads can vary based on the market conditions and the type of account you have. There may also be fees for overnight positions and inactive accounts. Detailed fee structures are provided on their website, ensuring transparency.

Opening an account with Forex.com is a straightforward process:

- Visit the Forex.com website and click on ‘Open an Account’.

- Fill out the online application form with your personal and financial information.

- Verify your identity and residence by uploading the required documents.

- Once verified, fund your account to start trading.

Forex.com provides customer support through several channels:

- Live Chat: Available for quick queries directly through their website.

- Email Support: Suitable for more detailed questions, with responses typically within one business day.

- Phone Support: Direct access to support staff for immediate assistance.

Customer support is available 24 hours a day during the trading week, ensuring that help is available whenever the markets are open.